EUR/USD has been quite corrective recently in a range between 1.1850 to 1.1950 area. Today the market opened with a gap downwards which pushed the price towards 1.1850 support area. EUR/USD has been corrective as both currency in the pair seemed to have mixed economic reports lately which did not quite impress the market sentiment to lean on any direction whereas EUR has been struggling more because of the recent Germany issue which made the currency a bit weaker against USD. Today EUR Spanish Unemployment Change report is going to be published which is expected to decrease to 54.3k from the previous figure of 56.8k, Sentix Investor Confidence report is expected to show decrease to 32.3 from the previous figure of 34.0 and PPI report is also expected to show decrease to 0.4% from the previous value of 0.6%. Along with these economic reports today, Eurogroup meeting is going to be held where economic policies and economic health will be discussed which is expected to be quite neutral and have minimum impact on the market. On the USD side, today only Factory Orders report is going to be published which is expected to be negative at -0.3% from the previous positive value of 1.4%. This week is going to be a very high impact based period for USD as Non-Farm Employment Change, Unemployment Rate and Average Hourly Earnings reports are to be published which is expected to inject some volatility in the market. Moreover, this week ECB President Draghi is also going to speak about the economic development and upcoming policies on Thursday which is a day ahead of the USD high impact reports. To sum up, USD is expected to gain good momentum over EUR in the coming days as Rate Hike in this month is quite imminent and any positive high impact economic reports will increase the probability for the currency to gain over EUR in the coming days. This week the price is expected to get a directional bias for the coming days of the month where USD is expected to dominate EUR.

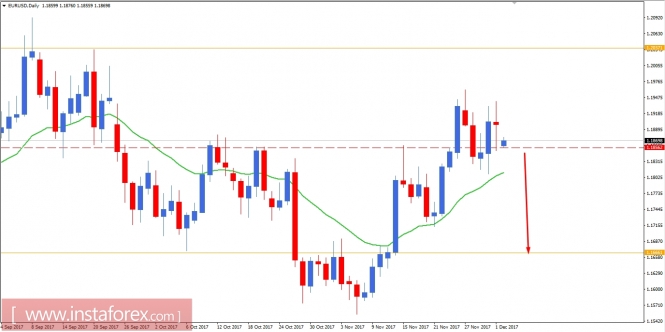

Now let us look at the technical view, the price is currently residing at the edge of 1.1850 support level after opening the day with a gap. Friday candle was quite indecisive but a bearish body did signal that bears are in better form than bulls. In this scenario, if the price breaks below 1.1850 with a daily close today then we will be looking forward to a bearish move down towards 1.1660 support area to be reached in the coming days. As the price remains below 1.1950 resistance area the bearish bias is expected to continue further.