USD/CHF has been quite volatile recently having impulsive bearish and bullish daily candles. Recently, the Fed Funds Rate report was published, despite the increase in the rate to 1.50% from the previous value of 1.25 as expected, USD lost significant grounds against CHF, which is currently recovering. Today the Libor Rate report was published: it was unchanged as expected at -0.75%. The PPI report showed some increase to 0.6% from the previous value of 0.5%, which was expected to decrease to 0.3%. The SNB Monetary Policy Assessment and SNB Press Conference was also held today where the outcome was not quite favorable for CHF resulting to losing some grounds against USD very quickly. On the other hand, today the US Core Retail Sales report was published with an increase of 1.0% from the previous value of 0.4% which was expected to increase to 0.6%. Retail Sales report is expected to increase to 0.8% from the previous value of 0.5% which was expected to decrease to 0.3%. Import Prices increased to 0.7% as expected from the previous value of 0.1% and Unemployment Claims showed a decrease to 225k from the previous figure of 236k, which was expected to increase to 237k. The positive economic reports did help the currency to regain its momentum which was expected from the Fed Funds Rate increase recently. As of the current scenario, USD is expected to sustain the gain over CHF providing more push to surge higher in the coming days.

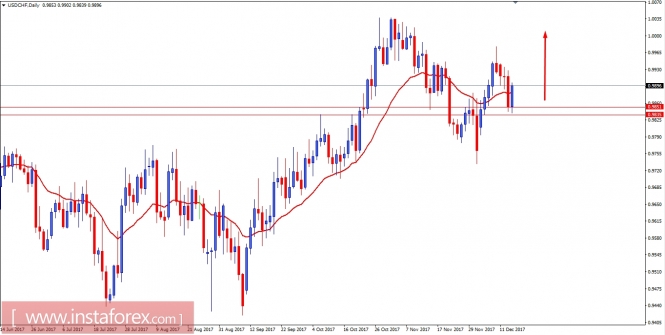

Now let us look at the technical view, the price has been impulsively bearish recently despite the Fed Funds Rate hike, which took the price all the way down towards the support area of 0.9830-50. Today, the price has been quite bullish with the gains having bounced off the support area with an aim of reaching the higher resistance area of 1.01. As the price remains above the 0.9830-50 support area, the bullish bias is expected to continue further.