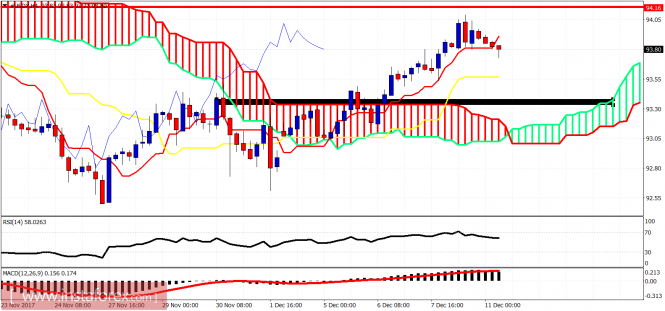

The Dollar index has hit the first important resistance area and is turning back downwards. From last week when we reached our 92.50 target in the index, we said a strong bounce should follow but bulls will also need to be careful in case we see a rejection at 94-94.15 area.

The Dollar index has broken below the 4-hour tenkan-sen. This is an initial reversal signal. Support is at 93.55. Next is at 93.40. Resistance remains at 94-94.15. Important short-term support is at 93-92.80. A break below this area will cancel my bullish view for 96-97.