Eurozone

The ECB did not make any additional statements regarding the pace of normalization of monetary policy at its regular meeting on Thursday. The markets assumed that a strong economic growth and a positive inflation forecast could provoke the ECB to come up with more specific wordings regarding the timing and pacing of the reduction of its incentive program but the bank preferred to remove unnecessary hype. In fact, it instead started calling on the markets to focus on previous indicators.

As a result, the euro immediately lost all the advantage over the dollar, which was gained literally only a day before. Now, the probability of continued growth has again become low. Key rates, as expected, were retained and they will "stay at current levels for a long period of time, even after the purchases of the asset regulator". Meanwhile, the buy-back program will last until September 2018 or further, depending on the development of the situation.

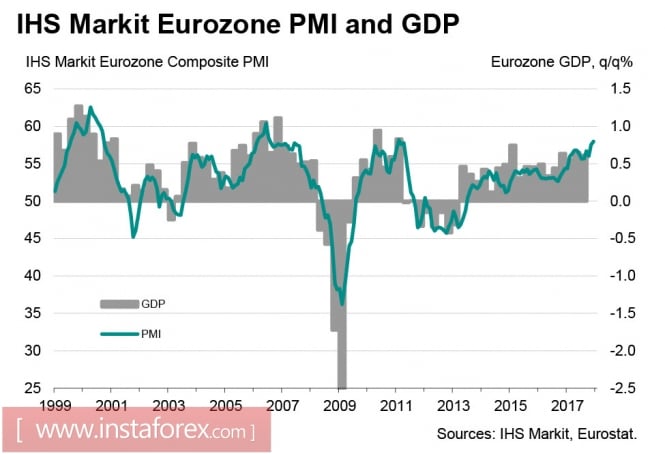

Thus, the possible driver of euro's growth disappeared without time for another driver to replace it. The market focuses once more on economic performance. PMI indexes continue to grow steadily. In particular, the production PMI has already exceeded the pre-crisis levels, reaching 60.6p, which is a 212-month high.

On Monday, the final data on inflation for the month of November will come out. On Tuesday, economic indices from IFO and a report on wages for the month of November will be published. The trend is positive. It is expected to grow to 2.0% but the overall level is still significantly lower than the pre-crisis level of 2.4%. This is one of the reasons why inflation forecasts are still acute.

The euro is losing initiative. We expect a decline to 1.1650 in the short term and fall even further to 1.1550 in the longer term.

United Kingdom

The meeting of the Bank of England merely passed, as it was not accompanied by the publication of updated macroeconomic forecasts. The rate remained unchanged and the Bank did not give any new signals regarding the change in monetary policy.

The report on retail sales published on Thursday confirmed the upward trend but did not make any impression on the markets. Apparently, the strength of inflationary pressures and the growth rates of average wages are still viewed by the market as not very optimistic.

The EU summit, which was concluded in Brussels, recorded the achievement of agreements on the first phase of talks between the EU and the UK regarding Brexit. However, this success is relative because of a number of key issues that are far from uniting the two region. The UK will remain within the scope of EU legislation and will pay membership fees at approximately 13 billion next year but will not have the right to vote. The pound has not received any advantages at the current stage and the only driver for its growth remains to be the high inflation.

This factor may not be enough. We expect the pound to fall to 1.3240 in the short term and move to 1.30 in the medium term.

Oil and ruble

Contrary to fears, oil prices continue to remain in the rising channel. OPEC + confidently seizes the initiative in regulating the supply. Three years of low prices have washed away many small companies that have come in search of quick profits from the market and US actions in the Middle East have increased political risks, which usually leads to an increase in oil prices. IEA indicates that oil reserves in developed countries have decreased to a minimum over the past two years and even the growth in production in the US and countries outside the OPEC + agreement does not guarantee the growth of reserves. Most of the factors indicate the approximation of the balance of supply and demand.

Oil continues to search for a point of equilibrium above the level of 65.30. There should not be a strong movement. However, the reasons for a turn to the south are still not enough.

Contrary to expectations, the Bank of Russia, having lowered the rate by 0.5% to 7.75% per annum, reserved the right to another decline in the first half of 2018. Despite the decisive actions of the bank, the ruble did not react with a decrease but, on the contrary, began to strengthen against the dollar. The likely reason is that the rate of decline in inflation was stronger than the market calculated which was less than 3% at the end of the year despite the conditions of lower rates, increase real wages, and a support for demand. In addition, the Bank of Russia raised its forecast for GDP in 2018, which, combined with improved forecasts for oil prices, may be the reason for the growth in the popularity of Russian assets.

The ruble will seek support at 57 rubles / dollar. However, there will not be a rapid decline.

The material has been provided by InstaForex Company - www.instaforex.com