Gold returned to the lower border of the trading range of $ 1265-1300 per ounce. This is where it has which stayed since September amid mixed dynamics of the USD index and the rates of the US debt market. Both the House of Representatives and the Senate expressed their approval of the tax reform but procedural errors caused the need for a second vote in the lower house of Congress. This factor, as well as the question in the air with the ceiling of the national debt, did not allow the US dollar to move into a large-scale offensive against competitors from the G10.

The support for precious metals was what made the Fed reluctant to raise inflation forecasts and federal funds rates at the last FOMC meeting this year. This was interpreted by investors as the Central Bank's uncertainty on whether a fiscal stimulus will force it to resort to a more aggressive monetary restriction than the futures market is currently waiting for. Prior to the meeting of the Open Market Committee, speculators actively ran out of gold, which led to a reduction in net long positions by December 12 to the lowest levels since July 25.

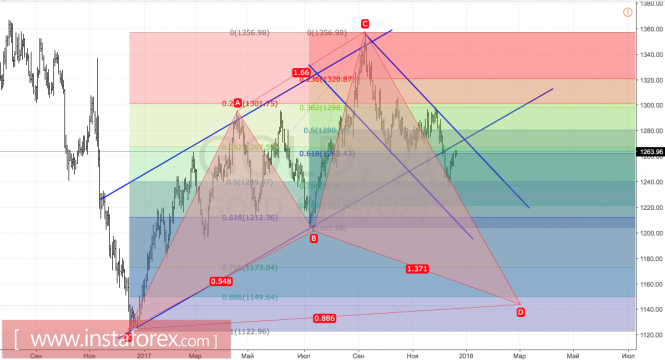

Dynamics of speculative positions on gold

Source: Bloomberg.

The normalization of the balance of the Federal Reserve and an increase in the rate of federal funds contributed to an increase in the yield of treasury bonds which cannot compete with them. At the same time, as the events of December 19-20 showed, the growth in interest rates and the USD index, which did not want to go up, allowed the "bulls" of the XAU / USD to cling to important resistance. And if the profitability rose against the backdrop of the growth of analogues from Germany inspired by the announcement about an increase in the emission of local 30-year bonds by 1.5 times in 2018, the "Greenback" prefers to wait for facts on the tax reform and the ceiling of the national debt.

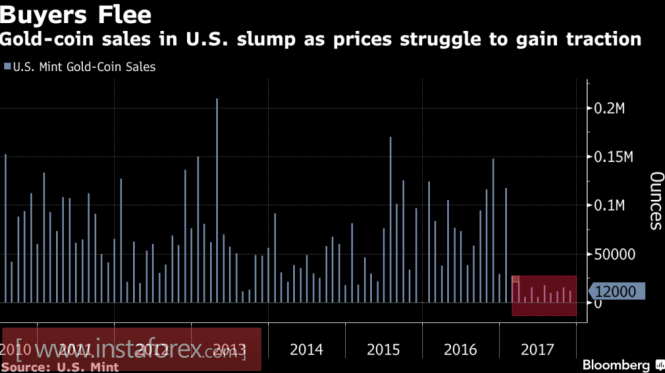

The market of physical assets, unfortunately, cannot throw a life ring to gold. Indian imports fell for the third month in a row. The People's Bank of China did not buy precious metals since October 2016. And bitcoin took investors to its side. So, in the US, sales of coins in November fell by 23% y / y. Practically from the beginning of the year, the indicator showed the weakest dynamics in a span of few years.

Dynamics of sales of coins by the American court

Source: Bloomberg.

Pressure on the position of "bulls" of the XAU / USD is improving the global economic background. While the IMF, the World Bank, and other authoritative organizations raise forecasts for world GDP growth, the ratio between gold and oil fell to the lowest level for the year. The first asset is a refuge while the second is an indicator of the health of the world economy.

Is the prospect of precious metal hopeless? I don't think so. First, in the second half of 2018, more central banks will talk about the normalization of monetary policy, which will limit the growth potential of the dollar. Secondly, the risks of correction of the S & P500 force investors to keep part of the positions in the assets-shelters.

Technically, the future fate of gold will depend on the resistance test at $ 1262-1267 per ounce. The success of the "bulls" will allow us to talk about the imminent formation of the pattern "Cheating-ejection", failure will increase the risks of implementing the target by 88.6% on the pattern of "Shark".

Gold, daily chart