The markets during the Asian session were sideways in anticipation of more interesting events of the next days. AUD is weaker after GDP data, which is beneficial for NZD. USD is in the middle of the congestion zone. Indexes lose under the pressure of falling metal prices. In China, stock indices are also under pressure - Shanghai Composite is losing 0.5% and Hang Seng is down 1.3%. Yesterday's copper price drop by almost 5.0% is blamed for the drop.

On Wednesday 6th of December, the event calendar is light in important news releases, but the market participants will keep an eye on German Factory Orders data, Consumer Price Index data from Switzerland, ADP Non-Farm Employment Change data from the US and Bank of Canada Interest Rate Decision and Rate Statement.

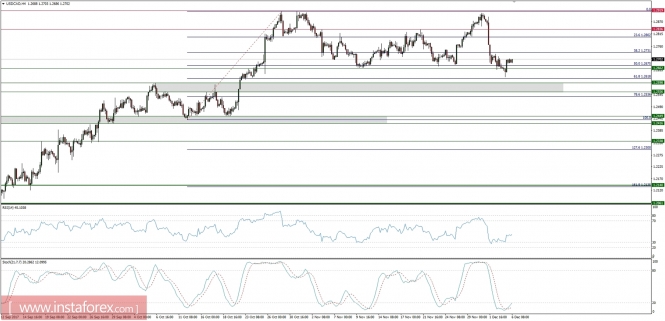

USD/CAD analysis for 06/12/2017:

Economists expect the Bank of Canada to stop this year on two interest rate increases. Although key data from the economy remain robust, the lack of signs of inflation acceleration suggests a cautious tone with regard to changes in monetary policy. Recently, President Poloz claimed that he needs time to assess the impact of the current increases on the economy and repeating this in the December statement may sound too neutral for the hawkish-oriented market. The rate decision is scheduled for 03:00 pm GMT and it should remain unchanged at the level of 1.0%.

Let's now take a look at the USD/CAD technical picture at the H4 time frame. The price broke through the technical support at the level of 1.2662, hit the 61% Fibo retracement at the level of 1.2618 and bounced back towards the congestion zone. The nearest technical resistance is seen at the level of 1.2731, but it can be easily violated if the BoC will not hike the rates as expected. The oversold market conditions support the temporary bullish outlook.

Market Snapshot: USD/JPY testing the trend line support

The price of USD/JPY dropped slightly again overnight to test the black trendline support around the level of 112.00 as a result of developing bearish divergence. In a case of a further drop, the next technical support is seen at the level of 111.41.

Market Snapshot: Crude Oil consolidates the gains

The price of Crude Oil is consolidating the recent gains ahead of US Inventories data ( scheduled for 03:30 pm GMT today). The market remains in a sideways zone between the levels of 56.78 - 59.04. A lack of upside and downside momentum supports this view.