In the foreground, there was a substantial growth of imports (17.7% y/y, consensus: 13.0%), which proves the high demand of Chinese producers for goods used in production processes. The export volume was also surprising, as from year to year it recorded as much as 12.3 percent jump. The scale of surprise clearly reflects deviation from market expectations, which just before the publication were at a modest level of 5.3 percent. At present, Tokyo's Nikkei 225 and Hong Kong's Hang Seng gain 1.4% from yesterday's close and 1.2% respectively. The Shanghai Composite Index (0.7%) is slightly less impressive, whose potential increase is trying hard to limit the companies from the banking sector.

On Friday 8th of December, the main event of the day is the US jobs data release including NFP Payrolls, Average Hourly Earnings, Unemployment Rate and Participation Rate. Besides this data, market participants will keep an eye on the UK Industrial Production and Visible Trade Balance.

GBP/USD analysis for 08/12/2017:

The end of the week on the currency market will not be particularly lazy. The name of the most important event of the Friday session is NFP Payrolls data (198k expected, 261k prior). The incoming "soft-data" clearly gives optimism before the latest estimates of the employment changes, thus increasing the likelihood of the unemployment rate dropping to around the level of 4.0%. The most interesting cards should be handed out to the pound sterling, which for a fraction of a second has become a beneficiary of a breakthrough in the Brexit negotiations.

Let's now take a look at the GBP/USD technical picture at the H4 time frame. The price has bounced from the lower channel line that corresponds to the technical support at the level of 1.3321. The oversold market conditions helped bulls to reach back the 78% Fibo at the level of 1.3521, but no new high has been made yet. The key level for bulls remains at the level of 1.3551.

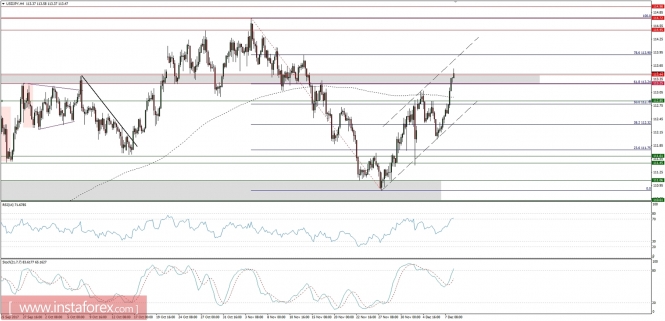

Market Snapshot: USD/JPY breaks above the resistance

The price of USD/JPY has broken above the 61% Fibo at the level of 113.24 and hit the technical resistance at the level of 113.44. The next target for the bulls is 78% Fibo at the level of 113.90. The strong momentum supports the temporary bullish outlook.

Market Snapshot: Gold has fallen even deeper

The price of gold has violated another technical support and felt as low as $1,243 in extremely oversold market conditions. Currently, the nearest technical resistance is seen at the level of $1,251 - $1,254 and due to the oversold markets conditions the bounce might occur anytime soon.