Optimistic forecasts of the IMF and the unwillingness of the US dollar to strengthen in response to the positive news about extending the US government's funding until February 8 allowed the bulls of Brent and WTI to return the initiative. Prior to this, the market was actively discussing the forecasts of the International Energy Agency and some speculators in the light of the potential growth in US production above 10 million bpd this year. They preferred to record profit on long positions.

IEA recalled the story of four years ago, when high prices for black gold increased the activity of shale producers in the States. This eventually resulted in the defeat of Brent and WTI. Alas, deja vu is unlikely to take place. And the reason for this is strong demand. According to the forecasts of the International Energy Agency, oil production in the US will increase by almost 1.4 million bpd to 10.4 million bpd, pushing the aggregate figure for non-OPEC countries to +1.7 million bpd. This is almost equivalent to +1.8 million bpd, indicated in the cartel agreement with other producing countries.

At the same time, global demand will increase by 1.3 million bpd and the IEA recognizes that this estimate is conservative compared with the forecasts of other organizations. They were +2 million bpd, which is twice the increase in 2014. Indeed, according to the IMF, the world economy in 2018-2019 will expand by 3.9%, which is 0.2 pp higher than in the previous assessments of the fund. It is ready to absorb current oil prices. At the same time, the reduction in global reserves speaks of a "bullish" conjuncture of the black gold market.

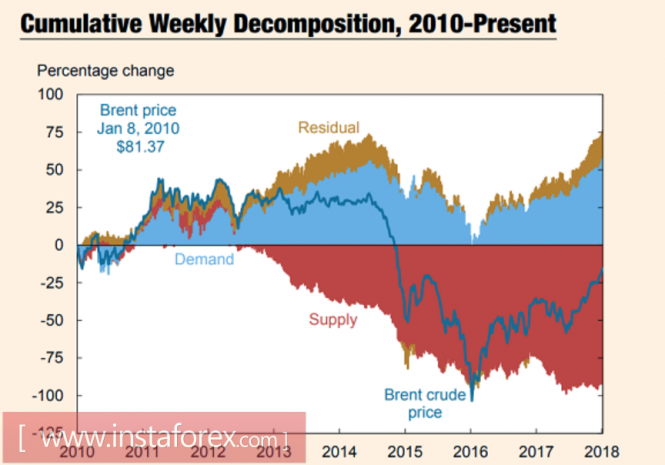

Dynamics of Brent, supply and demand of oil

Source: Financial Times.

Brent and WTI support the alignment of forces in the States, which, according to the IEA, are the main threat to the current uptrend. Despite the rapid rally of oil, producers are in no hurry to increase production and US black gold reserves have been falling for several weeks in a row, reaching their lowest level since February 2015.

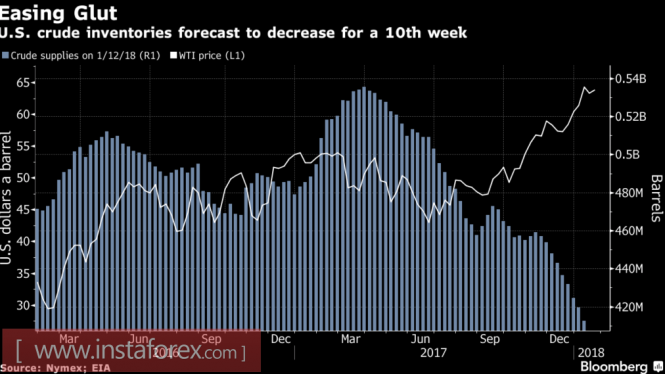

Dynamics of WTI and US oil reserves

Source: Bloomberg.

The hand of speculators who are not going to leave the record net-long are playing the statements of Saudi Arabia and a weak dollar. Riyadh, through the words of its oil minister, said that OPEC should not limit its efforts to the current year. The cartel should talk about broader time horizons for cooperation. However, there are rumors in the market saying that the organization will arrange Brent at $ 60 per barrel. This is just the same because of the fear of a possible recurrence of history with American producers in 2014. The recent correlation between the US dollar and the North Sea black gold grade supports the desire of the "bulls" over the latter to once again try to take an important level of $ 70 per barrel by storm.

Technically, the update of the January maximum will increase the risks of implementing the target by 161.8% on the AB = CD pattern. While Brent quotes are above $ 66.95 per barrel (127.2% on AB = CD), the situation is controlled by buyers.

Brent, daily chart