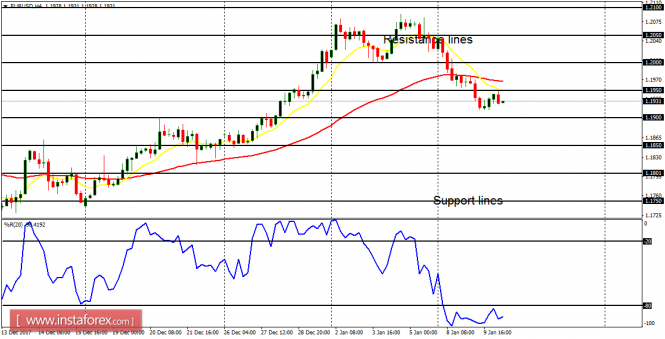

EUR/USD: There is a bearish signal on the EUR/USD pair, due to the perpetual bearish movement that has been witnessed on the market. The EMA 11 has crossed the EMA 56 to the downside, and the William's % Range period 20 is in the oversold territory. More and more bearish movement is anticipated.

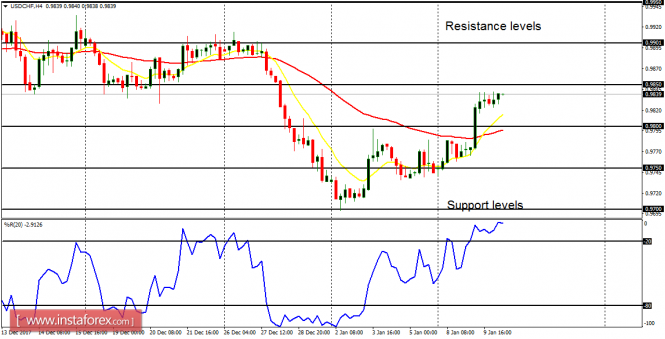

USD/CHF: There is a bullish signal on the USD/CHF pair, due to the perpetual bullish movement that has been witnessed on the pair (this week). The EMA 11 has crossed the EMA 56 to the upside, and the William's % Range period 20 is in the overbought territory. This does not mean a "sell" signal. Rather, it means the market would continue going higher irrespective of temporary pullbacks along the way.

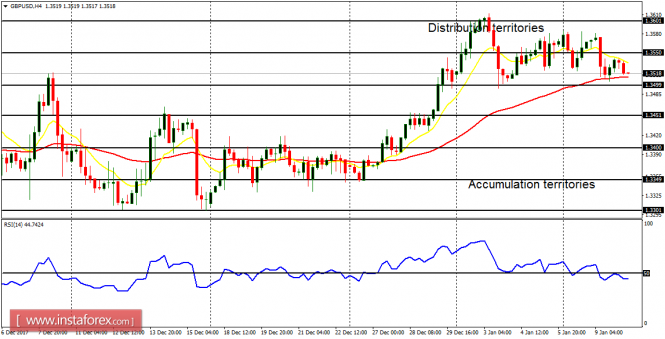

GBP/USD: This currency trading instrument has only gone flat so far this week. Price may be able to go upwards to test the distribution territories at 1.3600 and 1.3650. However, that does not eliminate possibility of a significant pullback, which may happen any time this month.

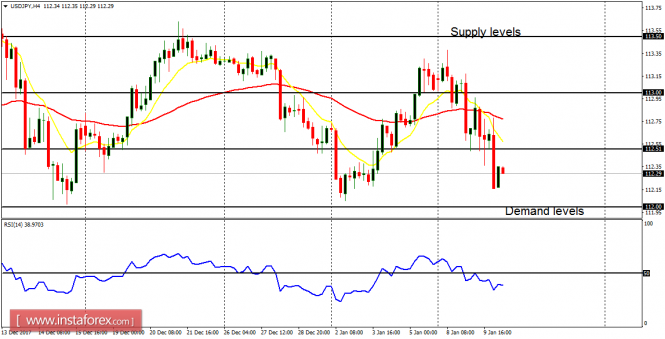

USD/JPY: The bearish threat that was witnessed on this currency trading instrument has finally translated into a bearish bias. There is a Bearish Confirmation Pattern in the market, and price could go towards the demand levels at 112.00 and 111.50. It is possible that these bearish targets could even be exceeded.

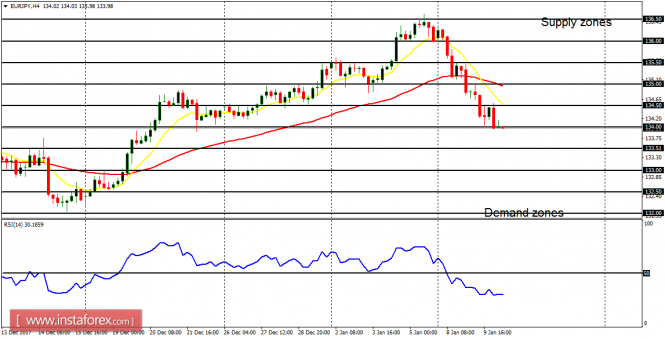

EUR/JPY: The EUR/JPY pair has been going downwards since the beginning of this week, and this tallies with the bearish expectation on JPY pairs. Price has gone south by 210 pips and it has tested the demand zone at 134.00. The next targets are the demand zones at 133.50 and 133.00, which would be tested soon.