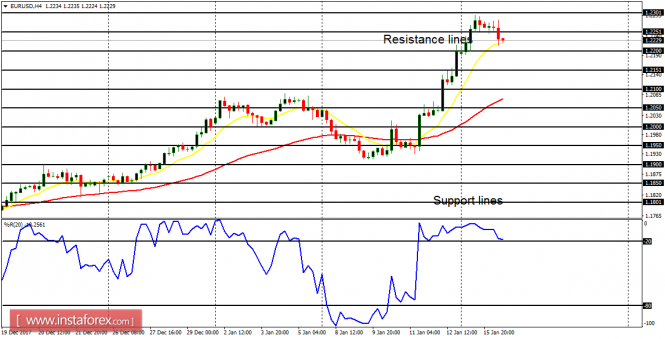

EUR/USD: The EUR/USD pair traded a bit lower on Monday, but that pales into insignificance when compared to the overall bullish bias. The market could still go upwards, reaching the resistance lines at 1.2250, 1.2300, and 1.2350. The resistance line at 1.2250 was previously tested and it would be tested again.

USD/CHF: The USD/CHF pair bounced a bit upwards on Monday. However, that cannot override the bearish bias. The market could still go downwards, reaching the support levels at 0.9600, 0.9550, and 0.9500. The support level at 0.9600 was previously tested and it would be tested again.

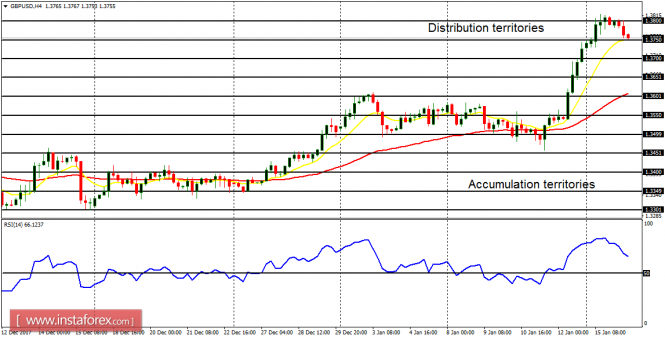

GBP/USD: The Cable experienced a shallow bearish correction on January 25, 2018 (in what can be called an uptrend). The bearish correction could turn out to be a wonderful opportunity to buy long at better prices. The Cable would go upwards by another 150 pips before the end of this week.

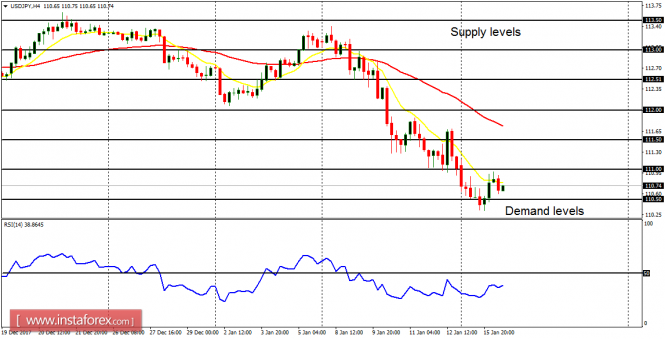

USD/JPY: The USD/JPY pair moved lower on Monday, in accordance with the overall bullish bias on the market. Any rallies in the market could be followed by further movements towards the south. The demand levels 110.50, 110.00, and 109.50 could be reached within the next several trading days.

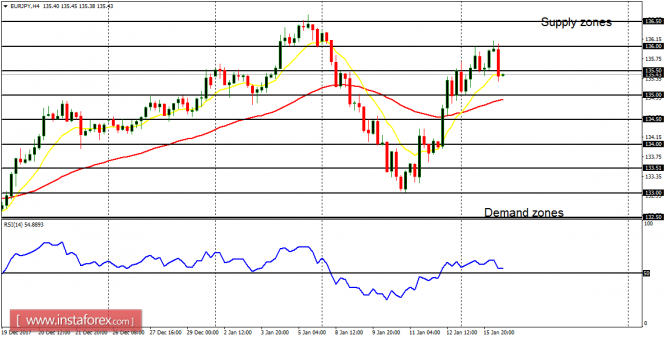

EUR/JPY: On this cross, there has been a Bullish Confirmation Pattern in the 4-hour chart. Price has moved northwards already and it is supposed to move upwards again, reaching the supply zones at 136.00, 136.50, and 137.00. There are demand zones at 135.00 and 134.50, which would try to impede bearish attacks along the way.