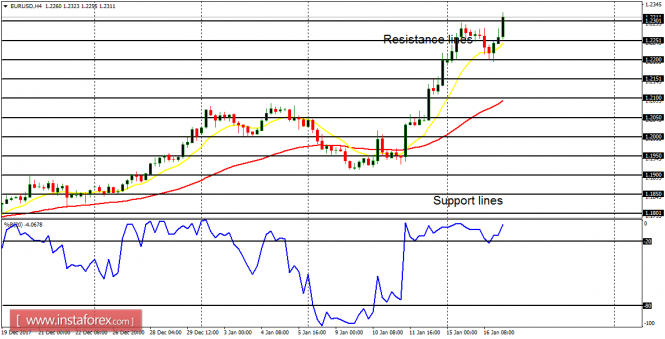

EUR/USD: The EUR/USD has gone upwards by over 350 pips since last week. It has gone upwards by over 100 pips this week, resulting in a huge Bullish Confirmation Pattern in the 4-hour chart. Further bullish movement is anticipated, for the price would reach the resistance lines at 1.2350, 1.2400 and 1.2450.

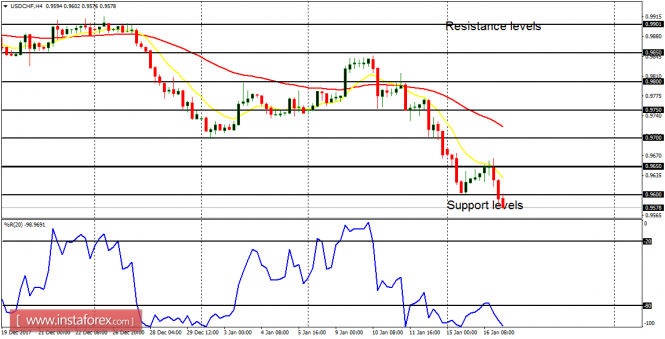

USD/CHF: This currency trading instrument has gone down seriously, going further southwards as the EUR/USD goes further upwards. Since last week, this instrument has dropped 180 pips, and it is now below the resistance level at 0.9600, going towards the support level at 0.9550 (the next target).

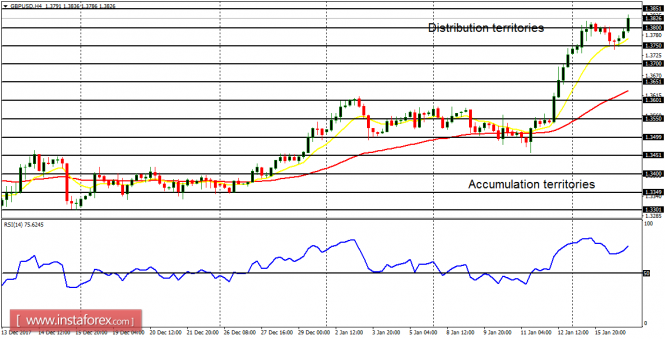

GBP/USD: The Cable has gone upwards by over 300 pips since last week. It has gone upwards by over 90 pips this week, resulting in a huge Bullish Confirmation Pattern in the 4-hour chart. Further bullish movement is anticipated, for the price would reach the distribution territories at 1.3850, 1.3900 and 1.3950.

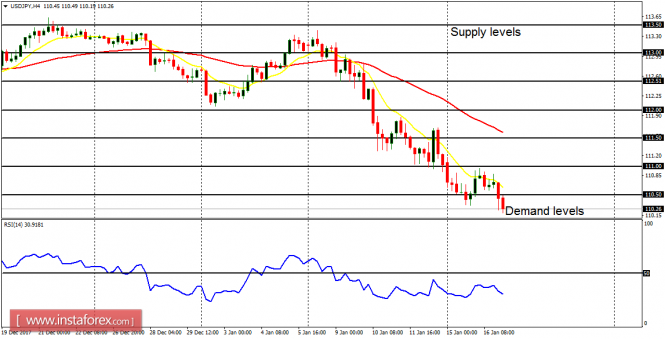

USD/JPY: Since January 8, this pair has come down by nearly 300 pips. This has helped form a bearish bias on the market. The EMA 11 is below the EMA 56, and the RSI period 14 is below the level 50. Further downwards movement is anticipated as price goes further downwards by another 100 pips (minimum).

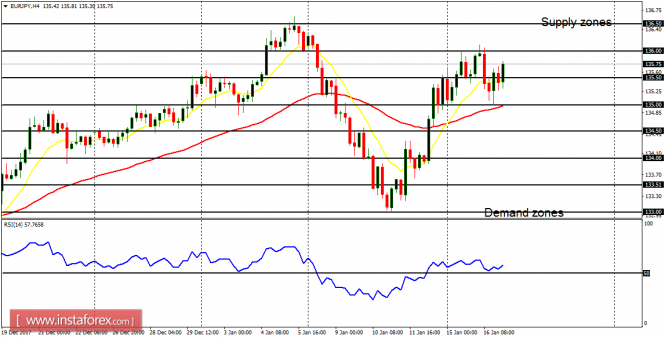

EUR/JPY: The bullish signal on this cross is still valid – although the market is quite choppy. By all indication, the price should continue going upwards, reaching the supply zones at 136.00, 136.50 and 137.00. These are the targets for this week, and bearish attacks are not supposed to take price below the demand zones at 134.00 and 133.50.