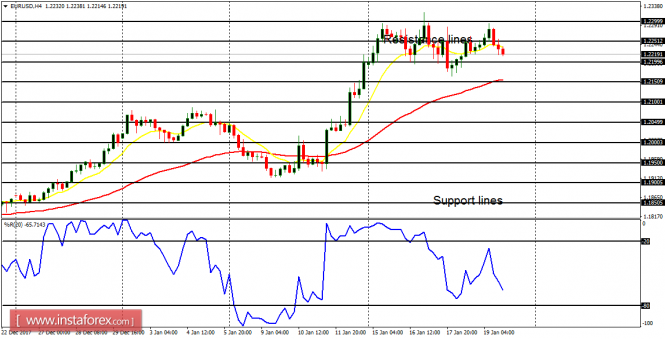

EUR/USD: The EUR/USD pair consolidated throughout last week, neither going above the resistance line at 1.2300 (which was tested unsuccessfully), nor going below the support line at 1.2150. This week, there is going to be a directional movement, which would most probably favor bears, for the outlook on EUR pair is bearish for this week.

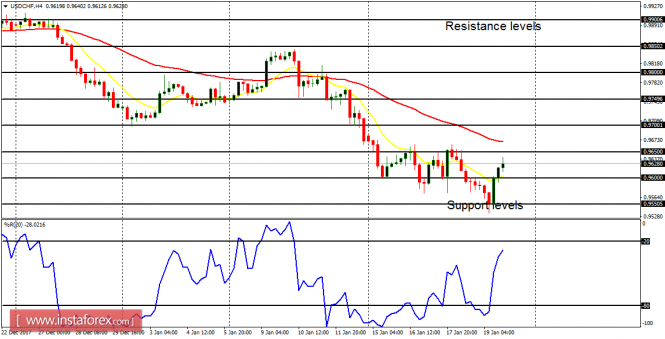

USD/CHF: This trading instrument went further bearish last week, testing the demand level at 0.9550 and then bouncing upwards on Friday. The demand level at 0.9550 would try to impede further bearish movement, and price could go upwards to reach the resistance levels at 0.9650 and 0.9700.

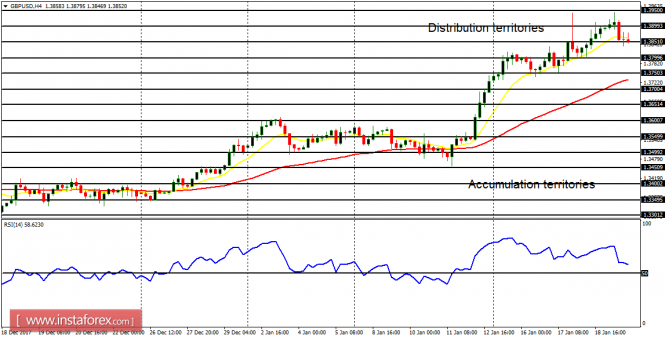

GBP/USD: This GBP/USD pair is in a bearish mode. The shallow rally that was in the middle of last week, turned out to be a nice opportunity to go short. It is much more likely that price would continue going southwards this week, because there could be some weakness in USD. The demand levels at 110.50, 110.00, and 109.50 could be reached.

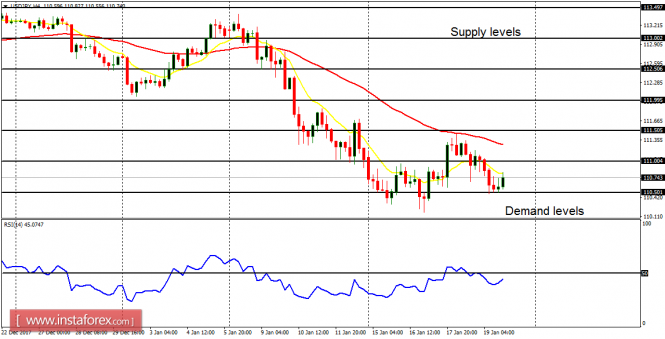

USD/JPY: This pair is in a bearish mode (there is a Bearish Confirmation Pattern in the 4-hour chart). Irrespective of the upwards bounce that was seen in the middle of last week, price was able to go lower on Friday. This week, the demand level at 110.50 could be breached to the upside, and one of the reasons is because of the expected weakness in USD.

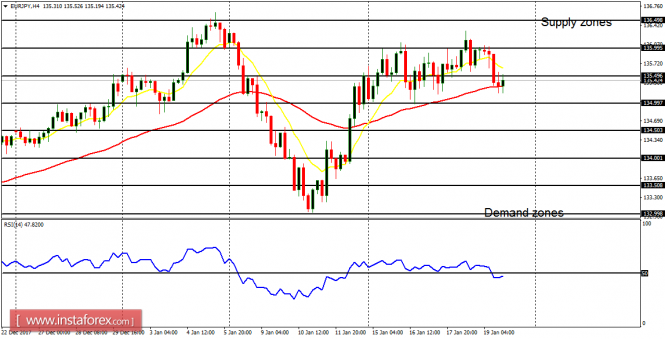

EUR/JPY: This market was rough and choppy last week, but price kept trudging upwards. Since there is a Bullish Confirmation Pattern in the 4-hour chart, the market may be able to reach the supply zones at 136.50 and 137.00 this week (even exceeding the supply zone at 137.00). The outlook on certain JPY pairs is bullish for this week.