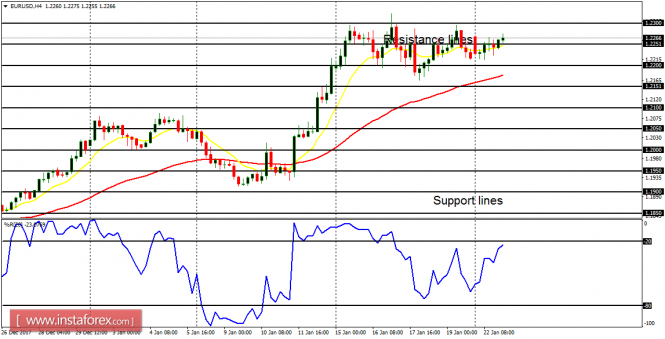

EUR/USD: This pair consolidated on Monday, neither going above the resistance line at 1.2300 (which was tested unsuccessfully), nor going below the support line at 1.2150. This week, there is going to be a directional movement, which would most probably favor bears, for the outlook on EUR pair is bearish for this week.

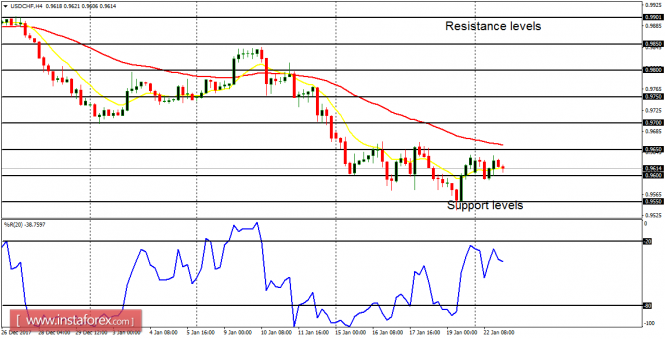

USD/CHF: This currency trading instrument did not do anything significant on January 22, but a rise in momentum is expected. The demand level at 0.9550 would try to impede further bearish movement, and price could go upwards to reach the resistance levels at 0.9650 and 0.9700.

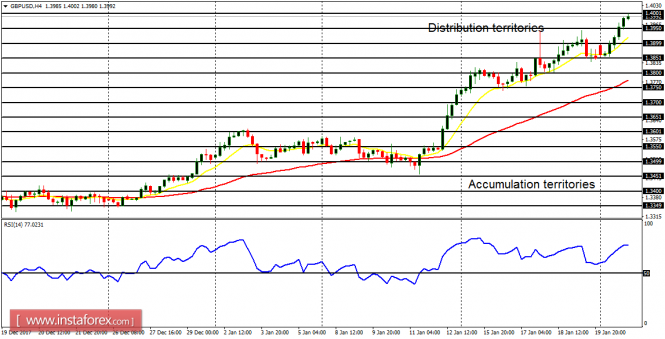

GBP/USD: The GBP/USD pair trended strongly on Monday, moving upwards by 130 pips. There is a strong Bullish Confirmation Pattern in the 4-hour chart, since price has moved upwards by 500 pips since January 11, 2018. The market can still go upwards by additional 200 pips this week, before there can be a serious pullback.

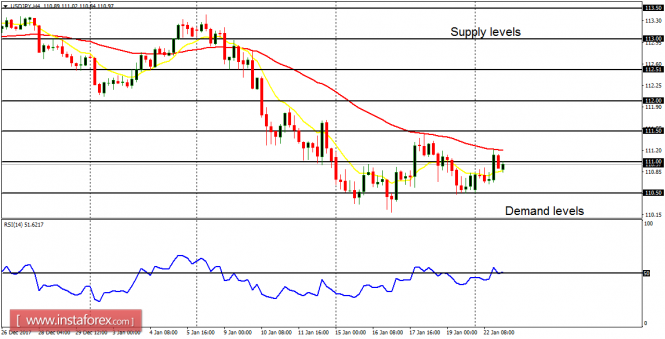

USD/JPY: This market made a shallow bullish effort yesterday (which it also made last week). All the bullish effort has been in the context of a downtrend and that may offer an opportunity to enter the market at better prices. This week, the demand level at 110.50 could be breached to the upside, and one of the reasons is because of the expected weakness in USD.

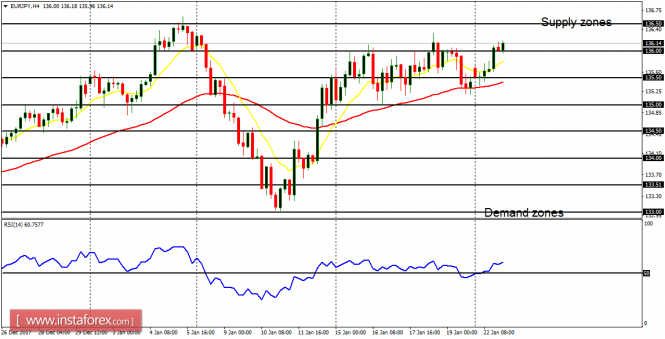

EUR/JPY: The EUR/JPY cross went north yesterday, moving above the demand zone at 136.00. The bias on the market is bullish, and price may go further upwards from here, leading to a stronger bullish outlook on the EUR/JPY pair. The next targets are the supply zones at 136.00, 136.50, and 137.00.