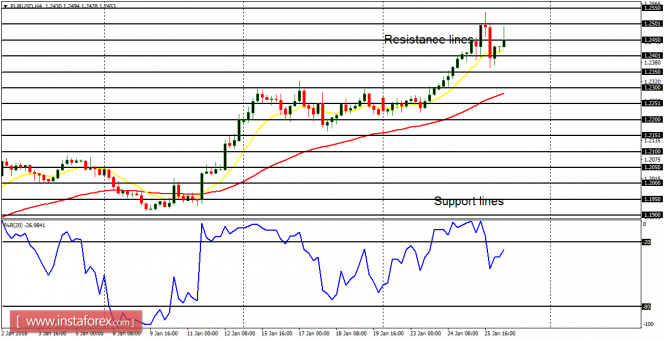

EUR/USD: The EUR/USD is in a bullish bias. The EMA 11 is above the EMA 56, and the William's % Range period 20 has always been around the overbought region (even when it temporarily goes out of the overbought region, it would go into that region again). There is a Bullish Confirmation Pattern in the market and price is going to move further northwards.

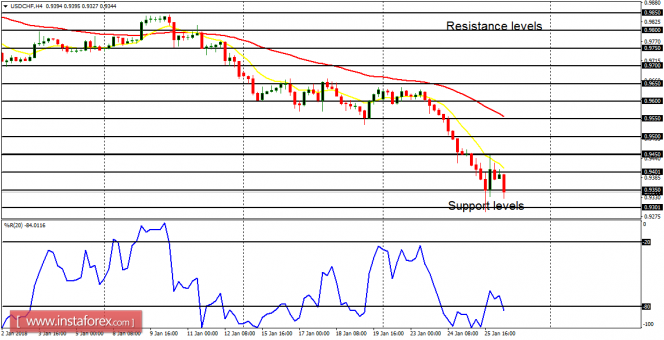

USD/CHF: This pair has gone downwards by 280 pips this week, testing the support levels at 0.9300. Price has bounced upwards and become quite choppy, but the bearish movement would continue, and so, the demand level at 0.9300 would be tested again, and it would be breached to the downside.

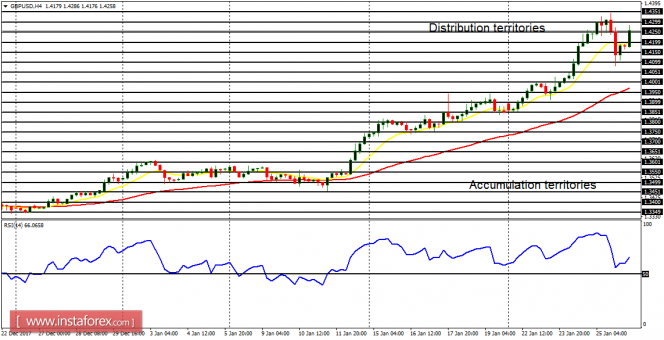

GBP/USD: This currency trading instrument trended strongly upwards this week, reaching the distribution territory at 1.4300. There was a pullback yesterday, but in the context of an uptrend. This means the market would go further upwards from here, after proffering good opportunities to go long at better prices.

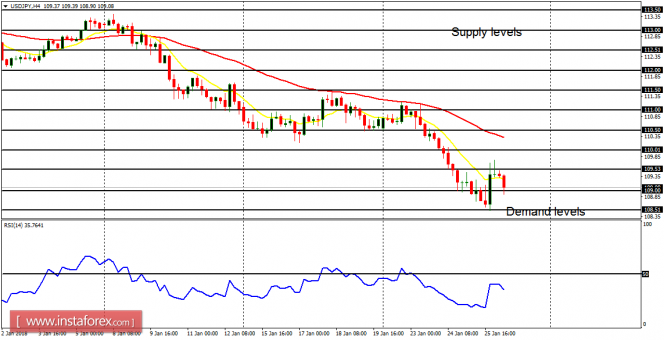

USD/JPY: The USD/JPY pair trended strongly downwards this week, having gone down by 210 pips. Since January 8, the market has shed about 420 pips. The demand level at 108.50 has been tested, before the current upwards bounce. Price has been coming downwards again, to test the demand level at 108.50, and to break it to the downside.

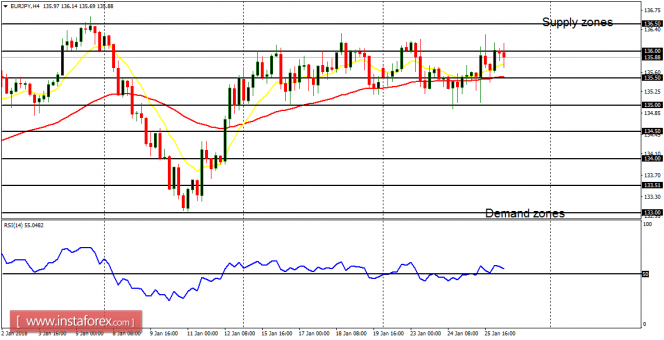

EUR/JPY: This is a sideways market, which oscillates between the supply zone at 136.50 and the demand zone at 135.00. The market is neutral in the short-term, but bullish in the long-term. Further sideways movement could bring out a neutral bias in the long-term. It is OK to stay away from this market right now.