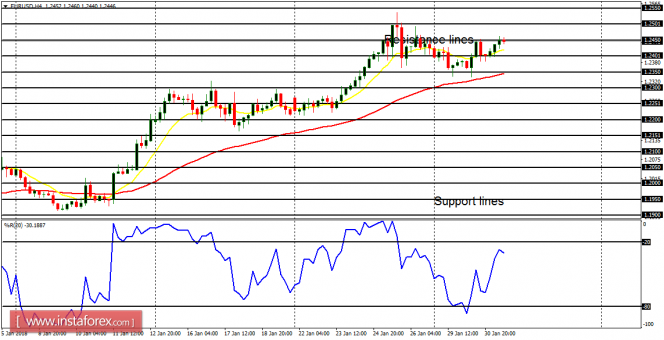

EUR/USD: Following the bearish correction that was seen at the beginning of this week, the EUR/USD pair is now going gradually upward again. The bias has long been bullish and price is expected to reach the resistance lines at 1.2500 and 1.2550 today or tomorrow. Pullbacks along the way are supposed to be temporary.

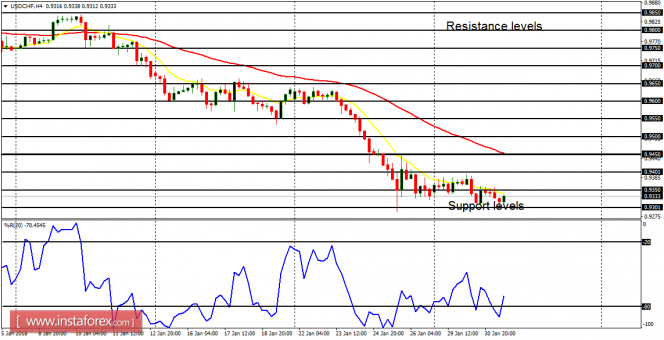

USD/CHF: In the short term, this pair consolidated on Monday and then began to move southwards gradually – in the context of an existing downtrend. Price is now below the resistance level at 0.9350, going towards the support level at 0.9300 (which would be breached to the downside as the market goes further south).

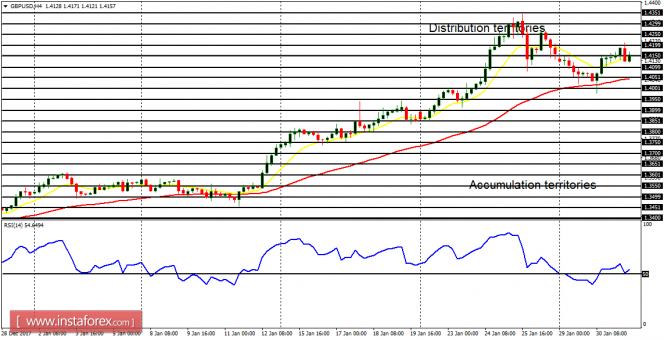

GBP/USD: Here, the pullback that happened on Monday and Tuesday has proven to be strong enough to threaten the existing bullish bias on the market. However, the bullish journey has continued and that put an end to the bearish threat. The EMA 11 is above the EMA 56, and RSI period 14 is above the level 50. There is a Bullish Confirmation Pattern in the market – price would thus go upwards.

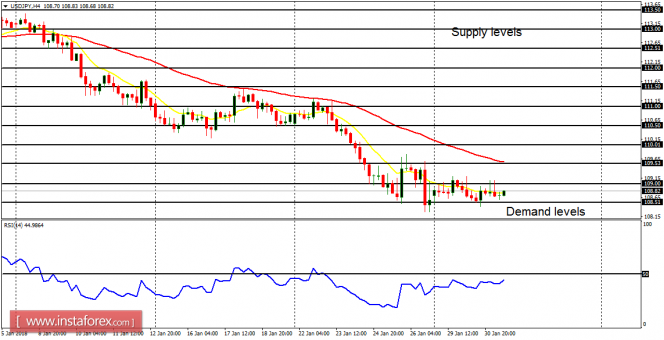

USD/JPY: The USD/JPY pair is currently consolidating in the context of a downtrend. The consolidation started at the beginning of this week, and it has held out so far. However, a breakout is imminent and it would most probably favor bears. So today or tomorrow, the accumulation territories at 108.50 and 108.00 could be tested soon.

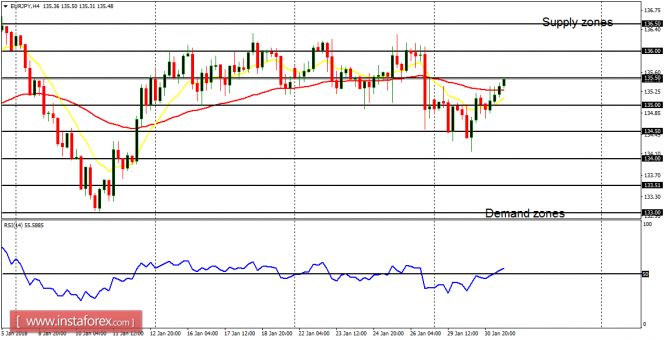

EUR/JPY: This market, which has been choppy for a few weeks (in the short-term), has started making a serious bullish effort. Once the supply level at 136.50 is overcome, the bias on the market will become bullish. Should this expectation fail to materialize, the choppiness in the market would continue.