The dollar exchange rate, the decline of which sharply accelerated after the introduction of protectionist measures on a number of goods from China and South Korea, against the backdrop of the comments of US Treasury Secretary Munchina about the weak dollar, won back some losses on Friday. The immediate reason for stopping the decline of the dollar was the comment of Donald Trump in an interview in Davos, in which he said that "the dollar will become stronger and stronger, and in the end I want to see a strong dollar."

The markets reacted to the words of Mnuchin in a downward direction, largely because in itself this statement was unusual - US officials prefer to stick to comments about a strong dollar. Trump smoothed the impact of the statements, saying that Mnuchin's words were taken out of context.

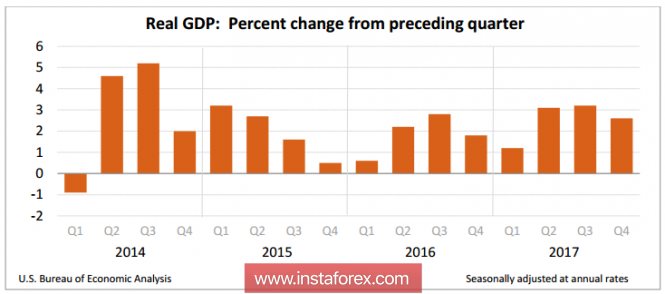

On Friday, the dollar also utilized the preliminary report of the Bureau of Economic Analysis for the 4th quarter. Despite the fact that GDP growth was worse than the forecast, the price index rose to 2.4% vs. 2.1% a quarter earlier, which plays in favor of inflation expectations.

Another factor in favor of the dollar is the report on orders for durable goods in December. The growth was 2.9%, which is higher than 1.7% in November and significantly above the forecast of 0.8%, meaning, the US consumer sector is growing steadily.

Nevertheless, the strengthening of the dollar is unlikely to be sustainable. The ECB on Thursday presented the markets with a bullish view on the outlook for the euro area, moreover, the focus of financial flows is not yet in favor of the dollar. The dynamics of the current accounts of the eurozone and the US are multidirectional. The CFTC report published on Friday confirms this conclusion - speculators resumed buying euro, the volume of long positions is increasing simultaneously with the growth of open interest, which clearly indicates a trend.

The dynamics of the bond market is mixed, but the growth rate of 10-year German bonds in recent days has sharply accelerated and is somewhat faster than the growth rate of similar treasuries. The ECB poured some oil on the fire, with the words of Mario Draghi expressing confidence in the further growth of inflation, which is facilitated by a strong economic recovery and clear signs of an increase in the average wage. It is clear that the market could not perceive these statements other than hawks.

The policy of revision of customs regulations can be continued next week. On January 30, Donald Trump will address the Congress, he is expected to raise the issue of investigating the transfer of intellectual property rights in exchange for access to Chinese markets, which ultimately can lead to sanctions against China's high-tech sectors. The probability of such a development is quite high, which can lead to an escalation of trade wars and a decrease in the dollar.

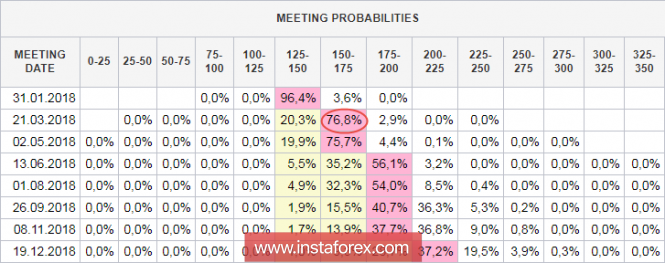

The main event next week is the Fed meeting on Wednesday, but the chances of raising the rate are very poor, the markets are set for a rate hike March and expect to see three increases this year. This meeting will be the last for Yellen.

On Thursday, the ISM report on the manufacturing sector will be published in January, the outlook is negative, as regional reports indicate a slowdown, and there is a notable gap between ISM and Markit, which it will seek to narrow down.

On Friday - the employment report for January, after a weak previous report, a small increase in the number of new jobs is expected, but the focus will be on the growth rate of average wages - the key factor in consumer demand and inflation at the moment.

After updating the lows and the subsequent rollback, the dollar will take some time to consolidate, so on Monday we do not expect strong moves. EURUSD may fall to 1.2323, where it will find support, the favorites will be commodity currencies, supported by a common interest in risk, AUD and CAD can update the highs immediately at the opening.

At the same time, its prospects remain weak, at least until the markets see that there is no problem with the budget's filling.

The material has been provided by InstaForex Company - www.instaforex.com