Eurozone

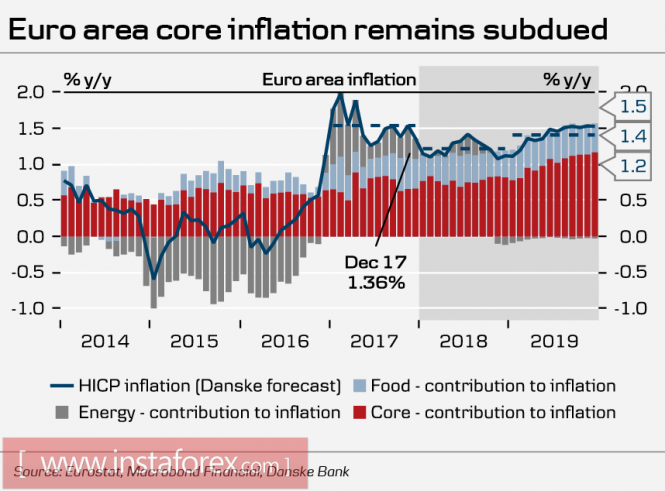

Published on Thursday, the minutes of the ECB meeting became a form of trigger not only for the euro, but for most European currencies. Quite unexpectedly for the market, the ECB turned a hawkish rhetoric, announcing that the economy is close to the trajectory of sustainable growth, and inflation has a good chance of approaching the target after the temporary factors cease to operate.

The market immediately changed its expectations regarding the completion of the asset purchasing program and the first rate hike, bringing this a step closer to June 2019. The market reacted with the rapid growth of the euro, pound and Swiss franc, judging that the deep integration of European economies will force the central banks of other countries to move towards the direction of tightening.

The positive mood was supported by the news that the leaders of the three German parties came to a decision on the creation of a coalition government, which provides a good chance of putting an end to the political crisis.

The key day of the coming week is Wednesday, when the report on inflation in the eurozone in December will be published. Despite the fact that overall inflation is gloomy, forecasts are moderately optimistic, the euro may get another important growth factor by the end of the day.

Forecasts for the euro are revised upward. Since November, the euro is in the growing channel after it confidently passed the resistance of 1.2092 with the nearest target of 1.24. The probability of a recoilless growth is not high, but the chances of a decline below 1.20 dropped noticeably.

United Kingdom

The growth of the pound is supported by a number of reasons for economic and political factors. This is, firstly, the weakness of the dollar, and secondly, the hawkish position of the ECB, which has already provoked an increase in the yields of 10-year Swiss bonds above zero, that is, it is a strong growth factor for all European currencies, and, thirdly, a contribution to rumors about the likelihood of the development of negotiations on Brexit. This time, insider information leaked into the markets that the finance ministers of France and Holland agreed on a soft version of Brexit, which could mean a softening of the position of the entire EU as a whole.

On Tuesday, an inflation report will be published, positive forecasts, the expected increase in inflation will lead to the pound's rise, as it will increase the probability of another hike in the rate of the Central Bank of England. A number of strong resistances are in the range 1.3850/3950, the pound's growth may be limited by this zone.

Oil

Oil continues to grow steadily, Brent's price has come close to the psychological level of $70/bbl. There are several reasons for the growth in the raw material market, starting with the unexpected weakness of the dollar and ending with China's confident purchase of record levels of raw materials in the foreign market.

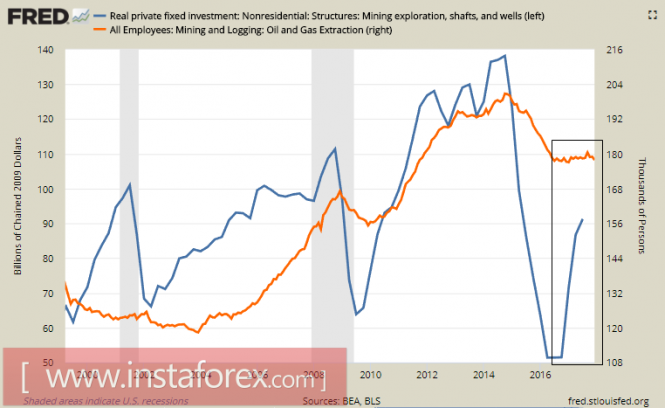

There is one more factor that looks different than what is being presented in the media. It is about increasing production in the US against the background of increased investment in the sector. Indeed, in the last 2 quarters there has been a small increase (about half of the peak in 2014), but more indicative is the stagnation in the labor market in the sector. Despite the growth in production, there is no evidence of an increase in employment, which means a lack of serious investment in the current quarter and lack of prospects for continued production growth.