AUD/JPY has been quite impulsive with the bearish gains after bouncing off the 89.00 resistance area recently. AUD has been the dominant currency in the pair for a few months now, but recently, with better economic reports, JPY is showing good gains along the process. Today, for the observance of Australia Day, no economic reports or events are taking place for which JPY had the full potential to dominate AUD, but failed to do so due to mixed economic reports. Today, JPY National Core CPI report was published unchanged at 0.9% as expected, Tokyo Core CPI report was published with a slight decrease to 0.7% which was expected to be unchanged at 0.8%, and SPPI report was also published unchanged at 0.8%. Moreover, Monetary Policy Meeting Minutes were neutral in nature having no short-term impactful policy decisions to effect the current market momentum. As of the current scenario, JPY gains are expected to slow down due to recent mixed economic reports which did not show much of an improvement for the currency. Until AUD comes up with any high impact economic reports in the coming days, JPY is expected to have stable gains but with slower momentum.

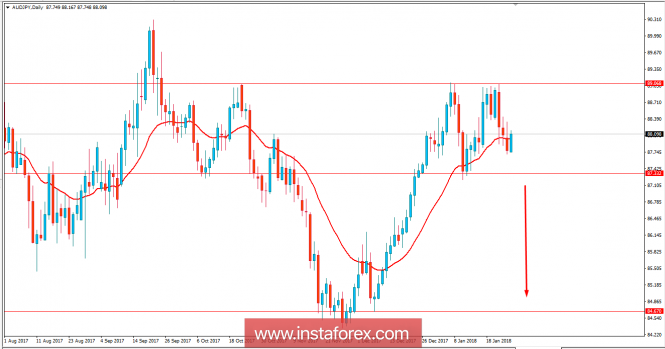

Now let us look at the technical view. The price is residing at the edge of dynamic level of 20 EMA between the levels from 87.30 to 89.00. The current residing area of the price has proven to be an area of traffic in the earlier months and for the current scenario, a daily close below 87.30 is expected to open the doorway for further bearish move in the pair with target towards 84.50 area.