EUR/USD has been quite indecisive this week having started with a Gap yesterday and bearish pressure sustaining along the way. The indecision on this pair is speculated due to neutral results of Euro group meeting and German Buba Monthly report which failed to provide enough evidence to gain over USD yesterday. On the Ahead of the EUR Minimum Bid Rate report to be published on Thursday this week, EUR seemed to have contained itself before an impulsive momentum. Though the Minimum Bid Rate report is expected to be unchanged at 0.0% this month following the Bid Rate report ECB Press Conference is expected to inject a good amount of volatility in the market. Today EUR ZEW Economic Sentiment report is going to be published which is expected to have a slight increase to 29.7 from the previous figure of 29.0, Consumer Confidence is expected to be unchanged at 1 and ECOFIN Meeting is also expected to neutral having a little or no impact on the EUR gains today. On the other hand, ahead of the Advance GDP report to be published on Friday, USD does not have any impactful economic event or report to provide strong momentum in the market. Today USD Richmond Manufacturing Index report is going to be published which is expected to decrease to 19 from the previous figure of 20. As of the current scenario, USD is expected to lose more grounds but EUR also does not have any impactful economic report or events on its side to favor its gains. As a result, we might observe a good amount volatility and consolidation this week whereas a weekly close may lead to a definite trend outcome this week.

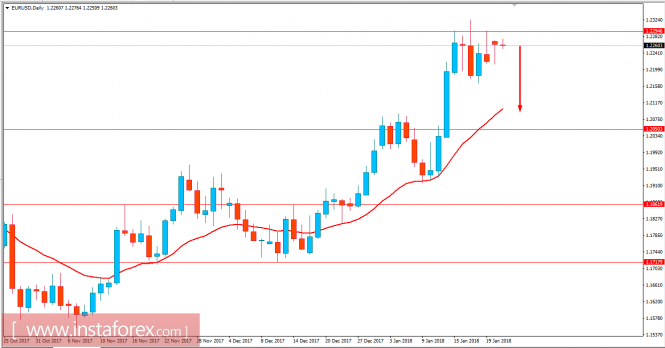

Now let us look at the technical view. The price is still quite bearish as of the current price action momentum whereas USD is expected to push the price lower towards 1.2050-1.2100 support area from where we might see some bullish momentum to carry on with the trend. As the price remains below 1.2300 with a daily close, the bearish bias is expected to continue further.