American lawmakers are so carried away by the rapid progress of tax reform through Congress that they completely forgot the question of who will pay for the banquet? Reducing taxes and increasing the budget deficit requires an increase in the issuance of debt obligations. In purchases of the latter, as a rule, non-residents are involved, the largest of which are Japan and China. They usually pay for the bright future of the US economy. In this regard, it becomes clear why information about the decrease in interest in US bonds by the Celestial Empire has produced the effect of an exploded bomb in the financial markets.

One can, of course, long argue what role in the statement of Beijing that "there are assets and more attractive" played Donald Trump's attacks on China, but the fact remains: if the Celestial Empire reduces its presence in the US debt market, the good for the dollar will not end. And the "American" immediately reacted to the news from Asia with a rapid fall, which allowed the gold futures quotes to restore the positions lost during the previous days and go to around $ 1325 per ounce.

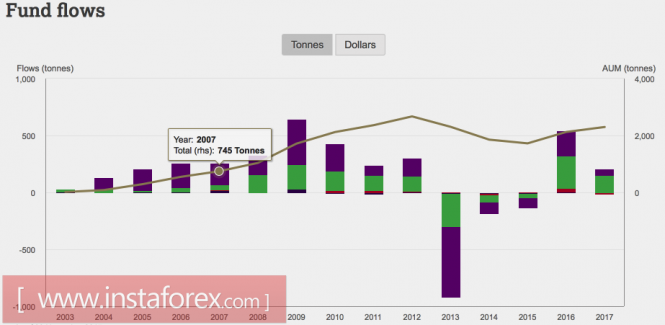

Dragmetal generally behaves quite unexpectedly, each time marking growth the next rate increase on federal funds. At the same time, the strengthening of the euro by 14% against the US dollar in 2017 was parallel to the growth of interest in products focused on gold ETF. 75% of the net inflow of capital was attributable to European funds (+148.6 tonnes), while Germany accounted for 35%. Asian ETF, by contrast, accounted for 54% of gross capital outflow. The question is, if the Celestial Empire has cooled to gold and to US bonds, what will it buy? The correct answer will make a good profit.

Dynamics of physical asset flows in ETF

Source: WGC.

Thus, Donald Trump needs to think three times before continuing to roll barrels to the largest countries of Asia, especially since Japan is also able to respond. The announcement that BoJ reduces purchases of long-term bonds in January, became the catalyst for the collapse of USD / JPY. This pair in recent months quite synchronously moved with gold, so the rumors about the normalization of the monetary policy of the Bank of Japan can be perceived as a "bullish" factor for the precious metal. Indeed, in this scenario, the chances of the USD index to restore the uptrend are zero, and the weakness of the dollar was traditionally perceived as a favorable external background for XAU / USD fans.

It is curious that gold is an asset-refuge, which usually falls into a wave of sales in the event of accelerating global GDP. This time, the precious metal rally coincided with an increase in world economic growth forecasts by the World Bank to 3.1% in 2018. According to the authoritative organization, for the first time since 2008, it will exceed its potential level. The reason for the deviations from the historical connection of the precious metal with global GDP should be sought in a weak dollar.

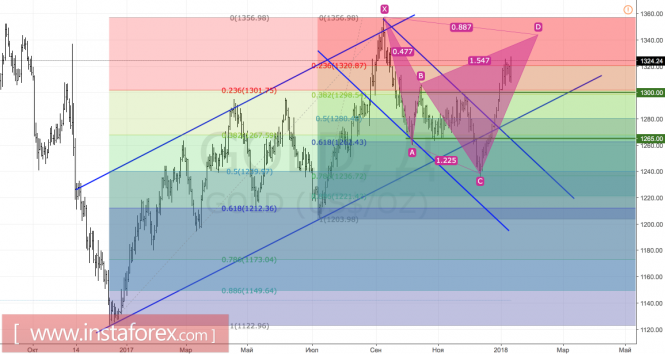

Technically, if the bulls on the analyzed asset manage to gain a foothold above the important level of $ 1321 per ounce, the risks of implementing the target by 88.6% on the pattern of the "Shark" will increase.

Gold, daily chart