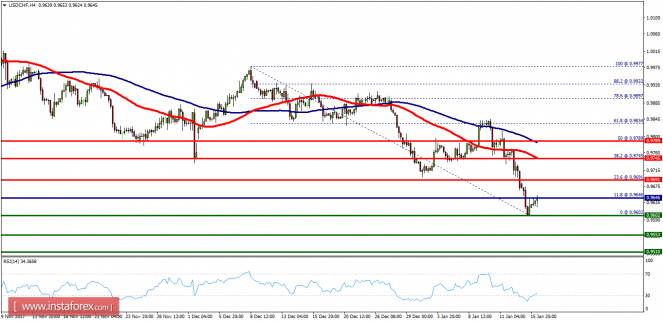

Overview:

- The USD/CHF pair continues to move downwards from the level of 0.9745. Yesterday, the pair dropped from the level of 0.9745 (this level of 0.9745 coincides with the ratio of 38.2% Fibonacci retracment levels) to the bottom around 0.9602. Today, the trend had rebounded from the bottom of 0.9602 to climp toward the level of 0.9650. Moreover, the first resistance level is seen at 0.9691 followed by 0.9745, while daily support 1 is seen at 0.9602. According to the previous events, the USD/CHF pair is still moving br, tetween the levels of 0.9691 and 0.9553; for that we expect a range of 138 pips (0.9691 - 0.9553). If the USD/CHF pair fails to break through the resistance level of 0.9691, the market will decline further to 0.9553. This would suggest a bearish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. The pair is expected to drop lower towards at least 0.9553 with a view to test the daily pivot point. On the contrary, if a breakout takes place at the resistance level of 0.9745, then this scenario may become invalidated.