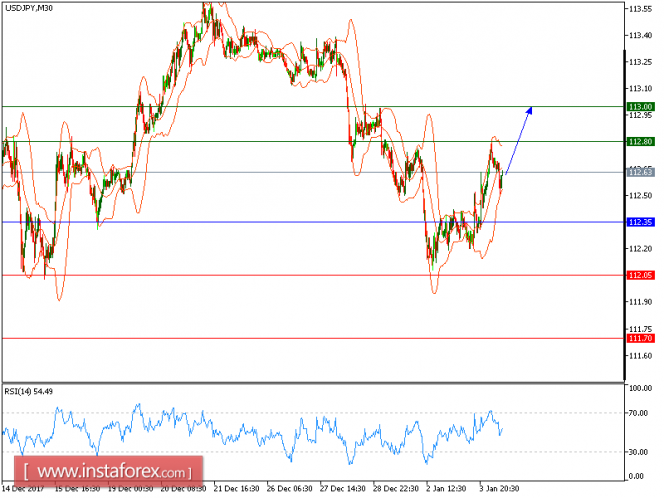

USD/JPY is turning upwards. The pair posted a rebound and broke its 20-period and 50-period moving averages. In addition, the bullish cross between 20-period and 50-period moving averages has been identified. The relative strength index calls for a new upleg.

The latest minutes of the U.S. Federal Reserve's monetary policy meeting in December showed that officials discussed speeding up interest-rate increases. The minutes read: "Participants discussed several risks that, if realized, could necessitate a steeper path of increases in the target range; these risks included the possibility that inflation pressures could build unduly if output expanded well beyond its maximum sustainable level, perhaps owing to fiscal stimulus or accommodative financial market conditions."

To conclude, as long as 112.35 is not broken, look for a further advance with targets at 112.80 and 113.00 in extension.

Alternatively, if the price moves in the opposite direction, a short position is recommended below 112.35 with a target of 112.80.

Chart Explanation: The black line shows the pivot point. The current price above the pivot point indicates a bullish position, while the price below the pivot point is a signal for a short position. The red lines show the support levels and the green line indicates the resistance level. These levels can be used to enter and exit trades.

Strategy: BUY, Stop Loss: 112.35, Take Profit: 112.80

Resistance levels: 112.80, 113.00 and 113.35 Support Levels: 112.05, 111.70, 111.50

The material has been provided by InstaForex Company - www.instaforex.com