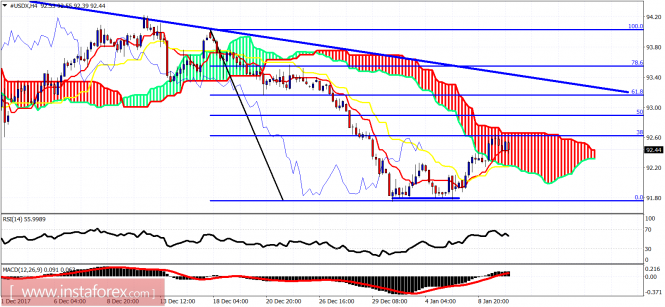

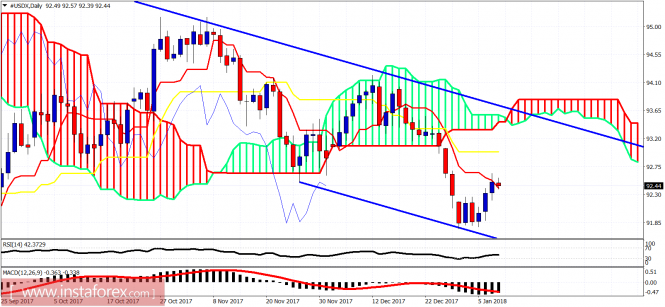

The Dollar index has reached its target of 92.60 as expected. Price is showing rejection signs at this resistance area. For the longer-term bullish view towards 96-97 to be achieved, we need to break yesterday's highs soon and move towards the important resistance of 93.60-93.70.

The Dollar index has bounced as expected but this could only have been a pause in the main down trend started at 95. It is very important for bulls to break above 92.60 and hold above 92.20. Next important resistance that bulls need to break is at 93.60-93.70. Daily trend remains bearish with high chances of a move below 91 as long as price is below 93.60.

The material has been provided by InstaForex Company - www.instaforex.com