Despite the fairly confident reports on retail sales and consumer inflation, the dollar has not yet found the strength to return to the growth trajectory.

Retail sales increased by 0.4% in December, the growth was fixed for the fourth month in a row. This is somewhat lower than forecasted, but in this case the negative is compensated by the revision of the indicators for October and December in the direction of increase. In addition to retail, sales of online stores increased significantly, in December the growth was 2.5%.

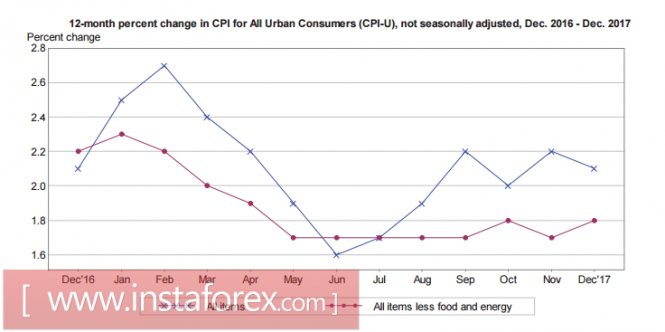

At the same time, the growth of core inflation accelerated. In December, it increased by 1.8% against the forecast of 1.7%, and in comparison with November's expansion of 0.3%, which is the maximum monthly increase for 11 months.

It should also be noted that the index of economic optimism from IBD/TIPP, reflecting the mood of consumers regarding the prospects for the US economy, increased in January to 55.1p , which significantly exceeds both the forecast of 52.3p and the December level of 51.9%, and is a 10-month high. In other words, consumers of the country favorably welcomed the start of the tax reform and are counting on improving the economic situation as a whole.

The inflation growth which was higher than anticipated improved expectations of an interest rate hike. According to the CME futures market, the probability of another increase as early as March is currently 72.6%, and for the first time the probability of a second rate hike in June exceeded 50%. Obviously, the markets are waiting for more aggressive steps by the Fed on the background of rising inflation expectations - the main deterrent of recent months.

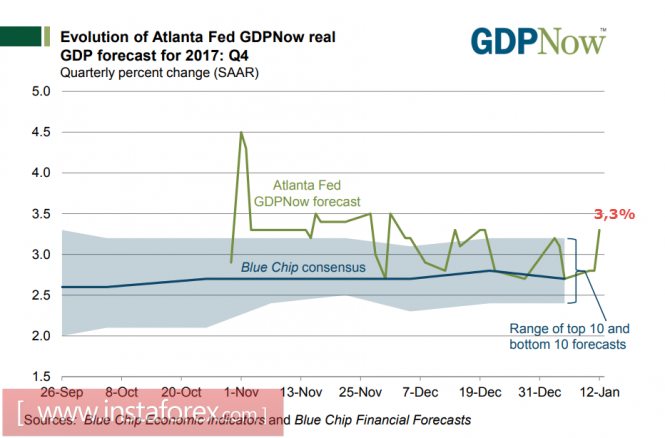

In general, the positive dynamics in a number of key indicators, such as export and import prices, production prices, retail and consumer inflation allowed the Atlanta Fed to improve its GDP forecast for 4Q. 2017 from 2.7% to 3.3%.

It would seem that strong data should contribute to the growth of the dollar, but the spot is dominated by the reaction to the exact opposite. Obviously, there are some serious concerns even against the backdrop of the growth of key indicators, but which ones?

All week long, the Fed leadership in its public statements voiced concerns about the future prospects of the US economy. But if in the speeches of Rosengren, Kashkari, Evans and Bullard, the emphasis was on inflation expectations and the need to somehow revise the inflation targeting policy, the head of the Federal Reserve Bank of New York Robert Dudley finally found the courage to point out the main reason for the market's concern - fears of fiscal instability.

Speaking at a conference on financial markets, Dudley said that in the long run, the risks to the US budget are increasing. In particular, Dudley noted that the cost of servicing the US public debt for the past 10 years has incidentally grown , from 237 to 265 billion dollars a year, and this is due to a record decrease in interest rates. However, a tightening policy with a simultaneous increase in rates will lead to the fact that the cost of servicing the US public debt by the year 2027 amounted to 800 billion dollars, or 3% of GDP, and the retirement of the baby boomer generation will lead to an increase in social security and health care costs to 6% and 5% of GDP, respectively.

In fact, Dudley just announced the calculations of the budget management of the US Congress (CBO), but his speech hid more serious concerns. CBO derives its calculations on the assumption that the tax legislation will remain unchanged, that is, there is still no reaction to reducing the amount of collected taxes and, accordingly, there are no figures for settlements either. In other words, the fears voiced by Dudley are just a prelude to the apparent budgetary failure that awaits the US after the introduction of the tax reform.

In attempts to increase revenues to the US budget, they increase pressure on the main trading partners, forcing them to seek countermeasures. This applies to Europe, China, and the nearest NAFTA neighbors. The outcome of this confrontation is not clear, but it is evident that the administration has no opportunity to win on all fronts, and the markets proceed from the fact that the US government will face serious difficulties in the near future, despite good economic performance.

The material has been provided by InstaForex Company - www.instaforex.com