The quotes of the USD / JPY pair fell to the lowest level in the last four months against the background of moderate "hawkish" comments by Haruhiko Kuroda and the continuing weakness of the US dollar. Eisuke Sakakibara, who is also known as "Mr. Yen" because of his power of influence in the foreign exchange market at the turn of the 20th and 21st centuries, expects the "Greenback" to cost £ 100 by the end of this year. Despite the fact that the previous comments of this person were ignored by the market, the situation this time is developing in such a way that the forecast has good chances to become a reality.

The rapid growth of the world economy with the best start of the US stock market since 1987 and the long-term highs on the Nikkei 225 show a high global appetite for risk which is a bearish factor for the yen. The yield of US Treasury bonds is growing by leaps and bounds and due to the high correlation in the USD / JPY pair in the year 2016-2017, we could expect the pair at around 115. In fact, the dollar has fallen below £ 109 for the first time since September. What's the matter? Why does the yen strengthen on an unfavorable external background?

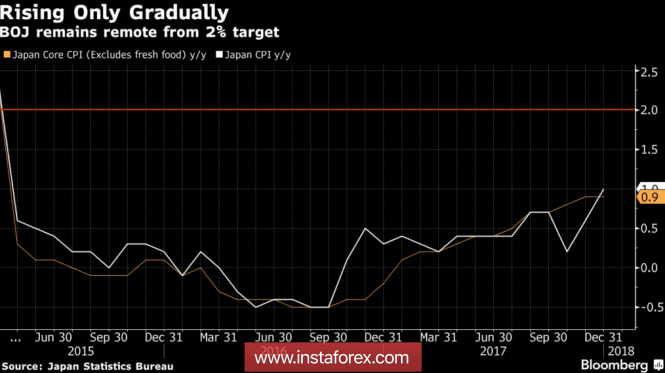

This is due to the growing expectations that the Bank of Japan will go through with the normalization of the monetary policy. Moreover, it is also because of the weakness of its main competitor. Before the eyes of investors is the example of the euro, which, thanks to Mario Draghi's hints of the ECB's departure from monetary expansion, grew by 14% in 2017. The yen added only two and given the fact that BoJ is going to follow in the footsteps of its colleagues from Frankfurt, it has a serious potential to take the same path. The market is not particularly embarrassed by the fact that core inflation and consumer prices in the Land of the Rising Sun do not exceed 1%.

Dynamics of Japanese inflation

Source: Bloomberg.

The "Bears" of the USD / JPY pair are getting half-hints and they are not tired of getting them. At the beginning of the year, Haruhiko Kuroda was talking about the dangers of negative rates for the banking system. At the International Economic Forum in Davos, he said that wages are not the only ones rising. Inflation expectations are growing as well. Thus, the BoJ approaches the goal. Such rhetoric contradicts the accompanying statement of the Central Bank following the results of its January meeting. The same Kuroda then noted that the regulator had not yet reached the stage at which it was necessary to think about the normalization of monetary policy, while the Bank of Japan maintained a modest inflation forecast with a + 1.4% for the 2018/2019 fiscal year.

Thus, no matter how much the BoJ wanted to limit the strengthening of the yen, it is an objective process that will be difficult to stop. Moreover, the positions of the US dollar still look vulnerable. Despite the implementation of the tax reform, the dispersal of US GDP, and the aggressive monetary restriction of the Fed, investors have already stopped paying attention to the "bullish" sentiment for the USD / JPY factors. The stronger the States and the world economy they lead, the more chances for the normalization of monetary policy by central banks-competitors of the Fed.

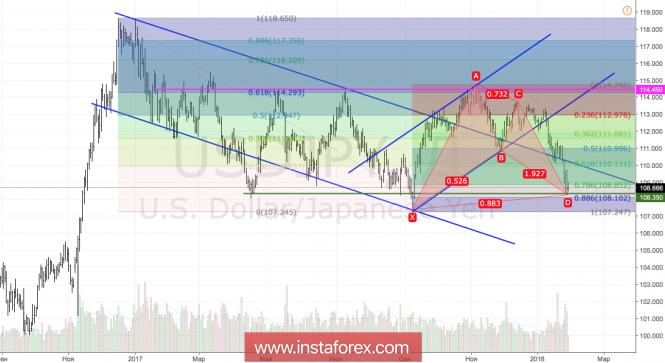

Technically, reaching a target of 88.6% for the "Bat" pattern and the lower boundary of the consolidation range 108.35-114.45 increases the risks of pullback.

USD / JPY, daily chart