Supporters of the bill on temporary financing of the US government could not get the required number of votes on Friday, and for the first time since 2013, US federal agencies stop working because of a lack of funding. Supporters of the bill failed to gain the necessary 60 votes to put the matter to a final vote, as Republicans and Democrats did not reach an agreement on immigration.

The lack of an agreement came as a surprise to the markets, as none of the political parties is interested in stopping the work of the government, since such a measure is very unpopular with voters. It was assumed that a temporary solution would be adopted for several days, during which the parties would try to come to an understanding, but these hopes were not realized.

The suspension of the work of the government is not connected with the problem of public debt. The US Treasury can still issue state bonds due to the adoption of so-called "extraordinary measures", within which non-market debt (that is, government debt) and commodity debt (non-government) may vary, with a general unchanged amount. Emergency measures will be exhausted in the spring, and if by that time no solution is found, the US will default on its debts.

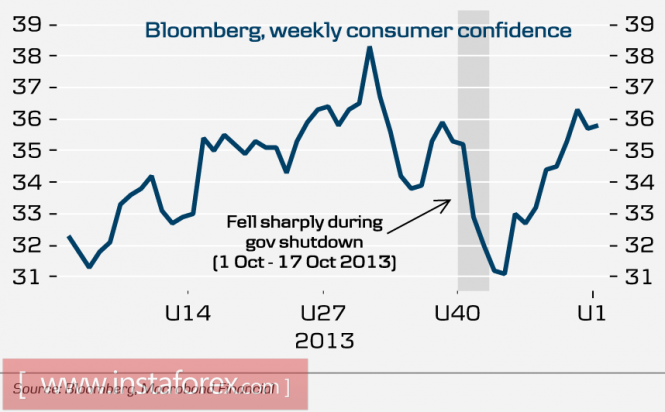

How does the current situation threaten the dollar? In 2013, the work of the government was suspended for 17 days, at which time the level of consumer confidence dropped sharply.

The loss in confidence, in turn, if it drags on, threatens to reduce consumer activity and, as a consequence, a decrease in the level of inflation, a decrease in GDP growth rates and revenues to the budget. All these factors can have a very negative impact on the plans of the Trump administration on budget reform.

The consumer confidence index from the University of Michigan is already decreasing instead of the expected growth. The preliminary value in January came in at 94.4 against 95.9 a month earlier and against the forecast of 97.0 p, primarily this result is associated with abnormally cold weather in much of the US territory, however, regardless of the reasons, the threat of a slowdown in GDP growth is already high.

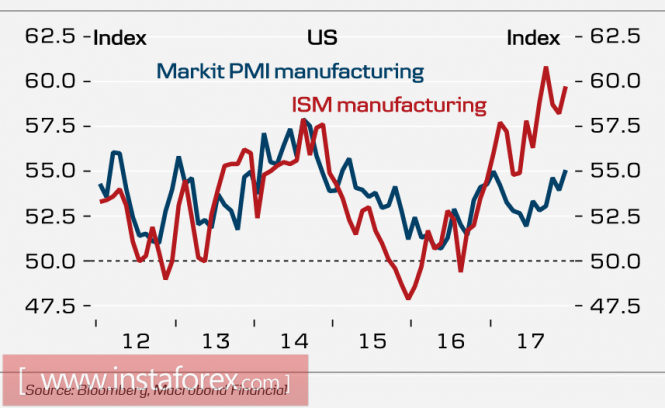

The main attention next week will be focused on the political aspects, as for macroeconomic factors, then there will be important releases and they will not have a noticeable impact on the dollar quotes. On Wednesday, preliminary business activity data from Markit will be published, already within six months the production index lags significantly behind the similar ISM index. The gap should somehow be closed, and therefore the probability of improving the indices will give some support to the dollar, expectations at the moment at 55.8 p against 55.1 in December.

On Friday, the first preliminary estimate for GDP growth in the fourth quarter will be published, and the situation in this regard is rather optimistic. According to GDPNow from the Federal Reserve Bank of Atlanta, the growth in 2017 was 3.2% A similar estimate from the Federal Reserve Bank of New York (NY Fed GDP Nowcast) indicate 3.9% growth. Perhaps at the moment this is the main factor that can support the dollar. Growth may be the strongest in the last three years, and, of course, attention will be directed to the dynamics of capital investments in December, and expectations are also positive.

Overall, the prospects for the dollar would be good, if not for a permanent political crisis. Next week, the ECB and the Bank of Japan will hold their meetings. The market does not expect any changes in monetary policy, which usually leads to an increase in interest in risk, and the dollar against this background could play a part of the losses. However, the confident projections of the government's default introduces strong changes in expectations, the dollar will remain under pressure and the chances for a resumption of growth are significantly reduced.

The material has been provided by InstaForex Company - www.instaforex.com