Thanks to an improving external background and unexpected growth of US stocks by 1.6 million barrels, by the end of the week by February 16, oil futures managed to close 8 out of the last 9 trading sessions in the green zone. Where are the fears that the extraction of black gold in the United States in 2019 will overtake a similar figure for Russia and come out on a clean first place? Why did the talk about the increase in drilling rigs from Baker Hughes go to the back burner? Traders say that they have not seen such a favorable macroeconomic background for a long time, which contributed to the rapid recovery of Brent and WTI.

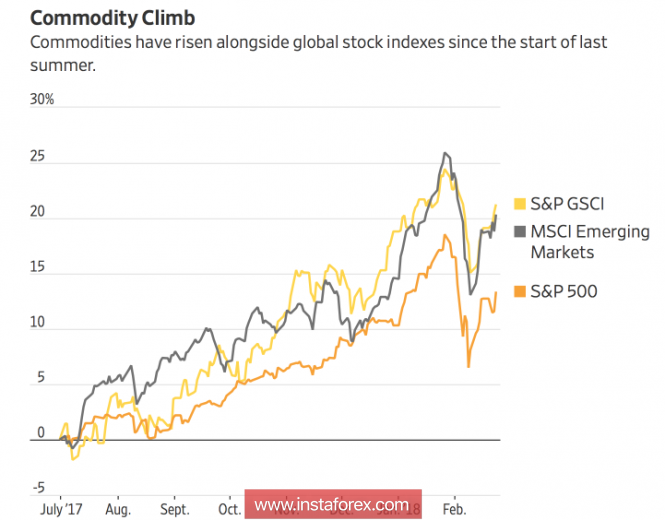

Driven by oil, copper and other commodities, the S&P GSCI Index, tracking the dynamics of 24 assets, jumped nearly 6% since February 9. Its movement is closely correlated with the US and global stock markets, while raw materials are clearly undervalued compared to equity securities. So, oil prices are only 56% of their highest levels reached in 2008, and the cost of gold and oil is only 30% and 31%. All this is well understood by hedge funds, whose long positions for black gold are 16 times higher than short ones.

Dynamics of commodity and stock markets

Source: Wall Street Journal.

While OPEC and American producers continue to pull the rope, the key factor is global demand. And investors are judging about its prospects for the dynamics of the S&P500 and other global stock indices. At the same time, the rapid recovery of the stock market testifies to the strong health of the global economy. And can it be otherwise, if the US GDP, without a fiscal stimulus, grows by leaps and bounds, and if we factor in the tax reform, then is it able to achieve growth at a permanent 3%?

Personally, I strongly doubt that the Fed is going to radically change its stance and abandon the idea of a gradual normalization of monetary policy. The central bank risks accelerating the selling of debt bonds, which will push the yield of 10-year US Treasury bonds significantly above 3% and thus provoke a correction of the S&P 500. Such development is seen to cause Donald Trump's discontent, who has repeatedly stressed that the success of the president's policy is reflected in the "bullish" trend of the stock market. Curiously, why should the proteges of the head of the White House cross his path?

References to the continuation of the course of monetary policy by Janet Yellen, in which the Fed must consider seven times before stopping (raise the federal funds rate), can weaken the US dollar. This, in turn, will have a favorable effect on oil prices. As constraints, expectations are for restoring an upward trend in US stocks and Britain's readiness for the first time in 14 years to become a net exporter of oil.

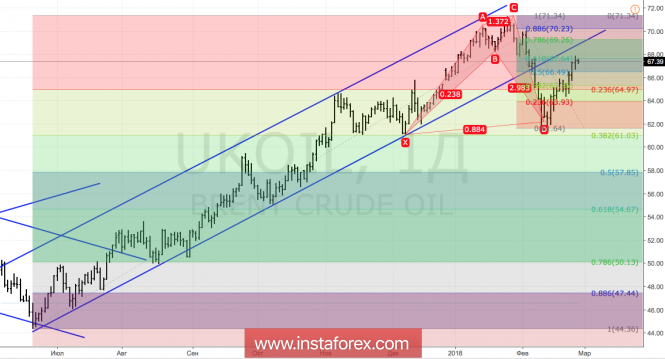

Technically continues the transformation of the "Shark" pattern in 5-0. Breakthrough of resistance at 78.6% and 88.6% of the wave of CD will open the "bulls" to the upward path. On the contrary, a return to support at $65 per barrel will increase the risks of correction.

Brent, daily chart