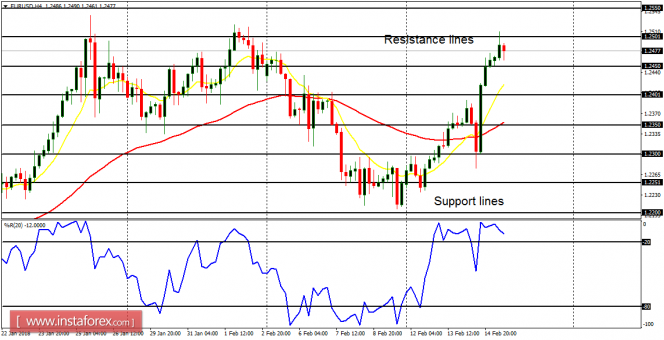

EUR/USD: The EUR/USD pair has gained about 250 pips this week... Having tested the resistance line at 1.2500. There has been a minor bearish retracement after the resistance line was tested, but price would go upwards again to test the resistance line and breach it to the upside. This would make the market target another resistance line at 1.3000.

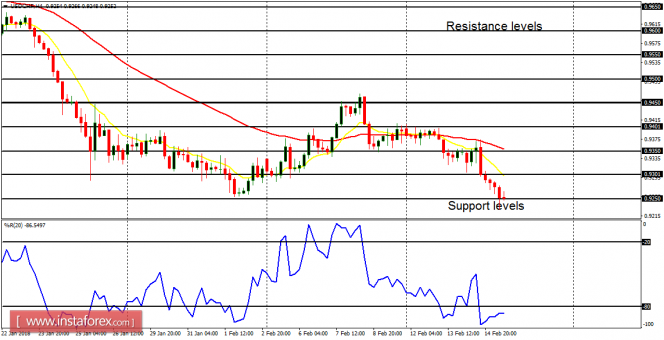

USD/CHF: The USD/CHF pair has continued its slow and gradual bearish movement, having shed about 120 pips this week. Price is now testing the support level at 0.9250 and it would breach it to the downside, as another demand level at 0.9200 is targeted. As long as the EUR/USD pair is strong, USD/CHF would be going bearish.

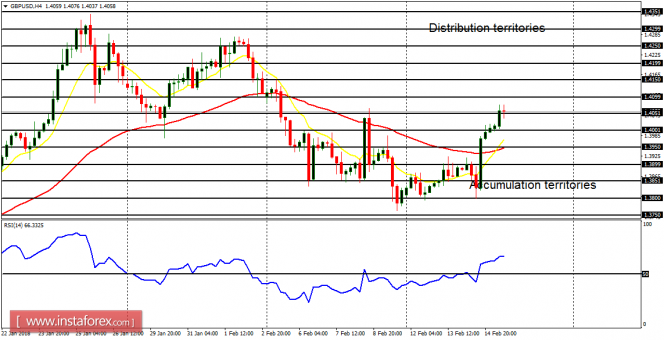

GBP/USD: A bullish signal has been generated on the Cable, as price went north by 260 pips, after its failure to breach the accumulation territory at 1.3800. A further northwards journey can help the market reach the distribution territory at 1.4100. Some fundamental figures are expected today and they may have an impact on the market.

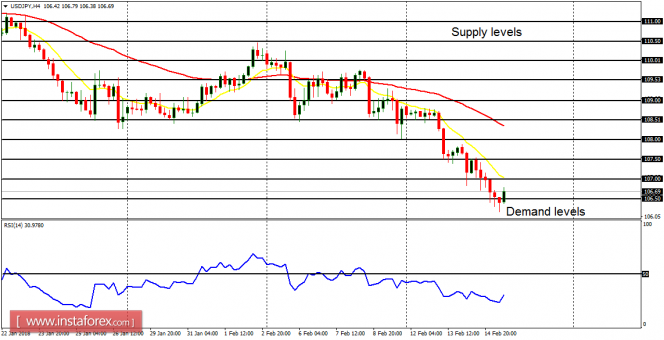

USD/JPY: This currency trading instrument has been engaged in a smooth, clean bearish movement for this week. The EMA 11 is above the EMA 56, and the RSI period 14 is now above the level 50. Since there is a Bearish Confirmation Pattern in the market, it is expected that price should be able to go below the demand level at 106.50, and remain below it.

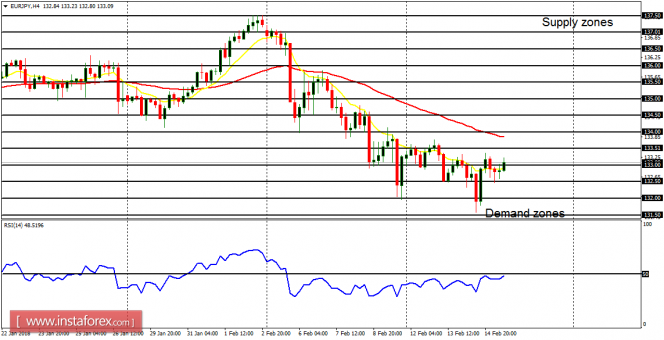

EUR/JPY: The EUR/JPY cross is a choppy and rough market (though the overall bias remains bearish). There is a subtle consolidation to the downside, which may become so serious, once the demand zone at 131.50 is breached to the downside. By then, the bearishness in the market could have become stronger.