AUD/JPY has been quite impulsive with the bearish gains recently, after breaking below 87.50 price area with a daily close. JPY has been the dominant currency in the pair this week as AUD had some downbeat economic reports. Australia published a series of worse economic reports this week which lead the currency to lose some grounds against JPY which in its turn had mixed economic reports. Today the RBA Monetary Statement was released where the bank forecasted the GDP growth of 3% on an average, an increase in Inflation of 3% by December 2018, and the unemployment rate was forecasted to decrease rapidly in the coming months. Along with it, today the Australian Home Loans report was published with a deficit of -2.3% decreasing from the previous value of 1.6% which was expected to be at -1.1%. Despite having worse economic report on Home Loans, AUD has been quite strong today due to positive forecast from the RBA provided in the Monetary Policy Statement. As for the news from Japan, today the M2 Money Supply report was published with a decrease to 3.4% which was expected to be unchanged at 3.6%. It has already hich fueled gains on the AUD side. As of the current scenario, AUD is expected to rise further in the coming days to recover some of the grounds against JPY. Until JPY comes up with positive economic reports to sustain its gains, AUD is expected to push the price higher.

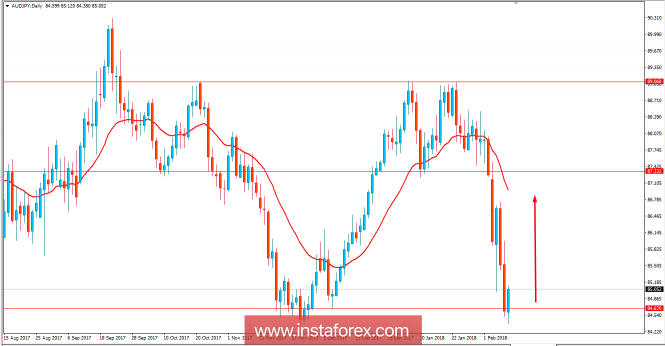

Now let us look at the technical view. The price is currently showing some impulsive bullish pressure off the 84.50 support area which is expected to help the price move higher towards 87.50 and dynamic level of 20 EMA in the coming days. The impulsive bullish pressure after the bounce from an important support level is indeed quite remarkable and as the price remains above 84.50 with a daily close, further bullish pressure is expected in the market in the coming days.