EUR/USD has been quite impulsive with the bearish gains recently after bouncing off the 1.25 resistance area. Despite having USD President's day and mixed EUR economic reports recently, USD gained impulsively which is expected to lead to further bearish pressure on the pair. Ahead of the FOMC Meeting Minutes to be held on Wednesday this week, the pressure against EUR does indicate the market sentiment ahead of the high impact economic event. Today EUR German PPI report was published with an increase to 0.5% from the previous value of 0.2% which was expected to be at 0.3%, German ZEW Economic Sentiment report was published with better than expected figure of 17.8 decreasing from the previous figure of 20.4 which was expected to be at 16.0, ZEW Economic Sentiment was also published better than expected at 29.3 decreasing from the 31.8 which was expected to be at 28.4 and Consumer Confidence which is yet to be published is expected to be unchanged at 1. Moreover, throughout the day ECOFIN Meeting is going to be held which is expected to have minimal impact on the gains of EUR for the coming days. As of the current scenario, USD is expected to gain further momentum where EUR failed to push higher having better than expected economic reports. As FOMC is expected to provide a hint about March Interest Rate Hike, USD may act more impulsively in the coming days which will result to further bearish pressure in the pair.

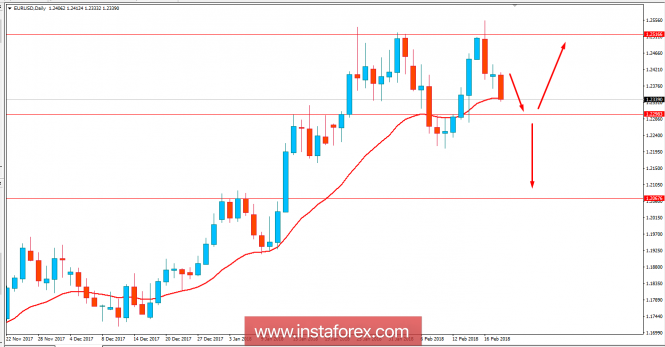

Now let us look at the technical view. The price has been quite impulsive with the bearish gains since the bounce off the 1.25 resistance area. The price may bounce off the 1.23 support area where the dynamic level of 20 EMA is also expected to act as a strong support for the price to push higher. A daily close 1.23 will lead to further bearish pressure on the pair after FOMC or else EUR may take the lead again to push the price higher towards 1.25.