NZD/USD found support at the dynamic level of 20 EMA today which is expected to push the price higher in the coming days. New Zealand published mixed economic reports whereas the market sentiment favours USD ahead of the possible rate hike in March. Recently, New Zealand's PPI Input report was published with better than expected value of 0.9% but with a decrease from 1.1% and PPI Output was published with unchanged value of 1.0% which was expected to decrease to 0.4%. Moreover, GDT Price Index report was published with drastic deficit of -0.5% from the previous value of 5.9%. Besides, the Credit Card Spending report was published with a decrease to 4.6% from the previous value of 6.2%. On the other hand, today the US Unemployment Claims report was published with better outcome at 222k decreasing from the previous figure of 229k which was expected to increase to 230k. The positive economic report with a decrease in Unemployment Claims indicates the positive changes in the US jobs market. Moreover, today USD CB Leading Index report is going to be published which is expected to increase to 0.7% from the previous value of 0.6%, Natural Gas Storage is expected to show less deficit at -121B from the previous figure of 194B, Crude Oil Inventories is expected to increase to 2.2M from the previous figure of 1.8M and FOMC Member Dudley is going to speak today about upcoming changes in the monetary policy and interest rate decision which is expected to be hawkish. As of the current scenario, the market seems quite indecisive and corrective. NZD is gaining momentum despite mixed economic reports whereas USD has the positive sentiment. Until impulsive pressure appears in the market due to positive economic reports from the US, USD is expected to have an upper hand in the future though NZD might gain for a certain period.

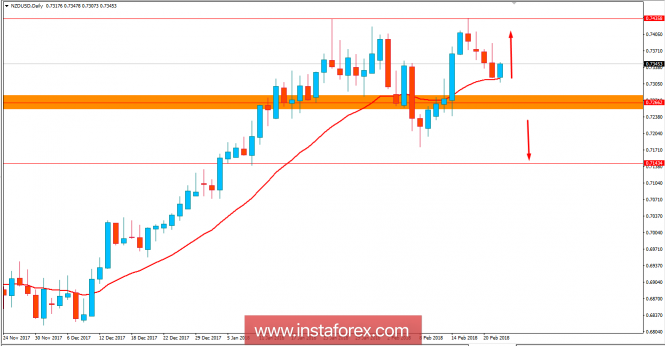

Now let us look at the technical view. The price has recently bounced off the dynamic level of 20 EMA and support level of 0.7250 price area. The impulsive bullish gain today has already engulfed the recent bearish pressure which is expected to lead to certain bullish pressure resulting to a push towards 0.7450 area. On the other hand, a daily close below 0.7250 will negate the bullish bias and force the price lower towards 0.7150 area. As the price remains above 0.7250 and dynamic level of 20 EMA with a daily close, the bullish bias is expected to continue further.