USD/CHF has been in a strong bearish trend since it bounced off 1.00 price area which is still quite stable and expected to continue further. Recently USD has pushed the price higher against CHF having positive Employment Change report but the bullish pressure is expected to end very soon. Recently CHF Trade Balance report was published with a significant decrease to 2.09B from the previous figure of 2.63B which was expected to increase to 2.78B. The worse outcome of the Trade Balance, CHF lost grounds against USD significantly which is expected to be recovered soon in the coming days. On the USD side, today Flash Manufacturing PMI report is going to be published which is expected to have slight decrease to 55.4 from the previous figure of 55.5, Flash Services PMI is expected to have slight increase to 53.8 from the previous figure of 53.3 and Existing Home Sales increase to 5.61M from the previous figure of 5.57M. Additionally, today FOMC Meeting Minutes is going to be held where it is expected to have a discussion about upcoming March 2018 Rate hike decision which might lead to certain volatility in the market. As of the current scenario, CHF is expected to proceed further with its gains against USD until USD comes up with any high impact positive economic report or event to help sustain the bullish gains in the pair. Ahead of the upcoming Rate Hike in March, USD is expected to correct itself against CHF before having impulsive gains.

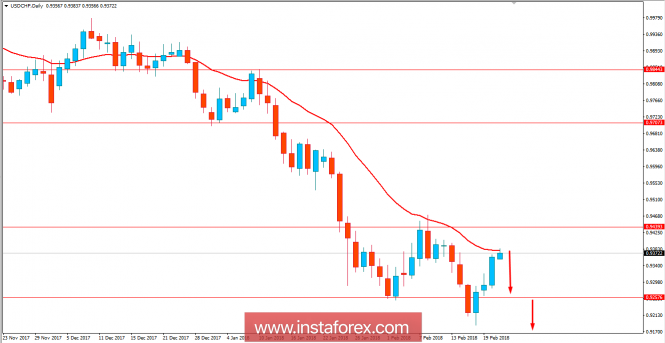

Now let us look at the technical view. The price is currently being held at the dynamic level of 20 EMA below 0.9450 price area. Though the bullish pressure has been quite impulsive recently as the price being contained by the dynamic level which is a sign of non-volatility and 0.9450 price area, the bearish gains are expected to continue further with the target towards 0.9200-50 price area and later towards 0.90.