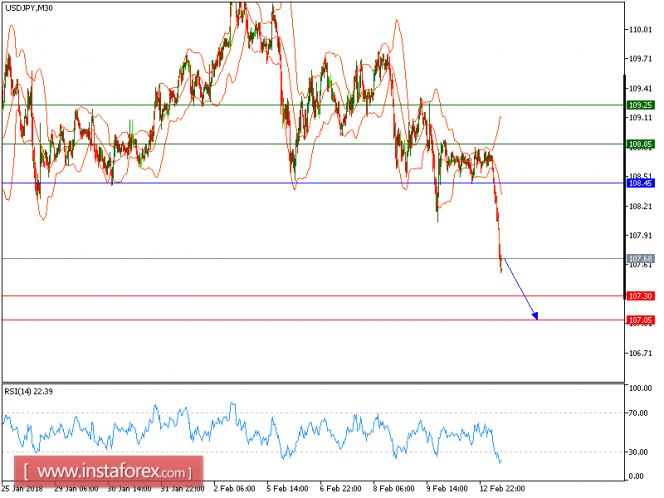

USD/JPY is under pressure. The pair has repeatedly tested the immediate support at 108.45. Currently, it has returned to levels above both the 20-period and 50-period moving averages, but remains capped by the key resistance at 108.45.

The U.S. dollar consolidated some of its recent gains, as stock markets showed signs of stabilization following two weeks of sharp declines.

Below 108.45, choppy trading with a bearish bias is expected. Crossing at 107.30 on the downside would trigger a further fall toward 107.05.

Alternatively, if the price moves in the opposite direction, a long position is recommended to be above 108.45 with a target of 108.95.

Chart Explanation: The black line shows the pivot point. The current price above the pivot point indicates a bullish position, while the price below the pivot point is a signal for a short position. The red lines show the support levels, and the green line indicates the resistance level. These levels can be used to enter and exit trades.

Strategy: SELL, stop loss at 108.45, take profit at 107.30.

Resistance levels: 108.85, 109.25, and 109.55

Support levels: 107.30, 107.05, and 106.75.

The material has been provided by InstaForex Company - www.instaforex.com