J. P. Morgan Chase added the cryptocurrency segment to the "Risk Factors" section in its annual report to the US Securities and Exchange Commission (SEC), yesterday. The annual report mentions cryptocurrencies in the "Competition" section, describing how new competitors threatening the activities of J.P. Morgan: "Both financial institutions and their non-bank competitors face the risk that payment processing and other services may be disrupted by technologies such as cryptocurrencies that do not require brokering". The report notes that these new technologies, including Blockchain, of course, although they do not mention it by name, "may require JPMorgan Chase to spend more money on modifying or adapting their products to attract and retain customers and match the products offered to them. competitors, including technology companies. " This competition may potentially "put down pressure on prices and fees for JPMorgan Chase products and services or may cause a loss of market share through JPMorgan Chase".

Last week, the Bank of America (BOA) published its annual report, which also included a mention of crypto assets as a threat to their operations, with the risk of competition described in very similar categories: "The widespread use of new technologies, including internet services, cryptocurrencies and payment systems, may require significant investment to modify or adapt our existing products and services".

The president of JP Morgan Chase, Jamie Dimon, called Bitcoin a "fraud" in September 2017 and threatened to dismiss any employee who would make a transaction involving Bitcoin and a company account. Since then, Dimon retreated a bit, telling reporter Cointelegraph at the World Economic Forum in Davos that he is not a cryptocurrency skeptic. At the beginning of February, the alleged internal report of JP Morgan Chase referred to cryptocurrencies as "innovative" and "unlikely to disappear", and to say that cryptocurrency could be successfully used in areas of payment systems that are traditionally problematic or slow.

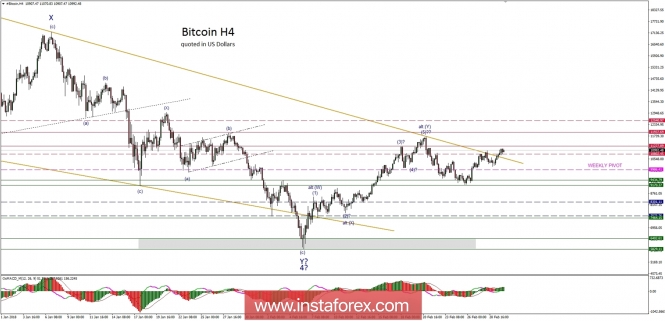

Let's now take a look at the Bitcoin technical picture at the H4 time frame. The market has managed to break out above the golden trend line and made a new marginal local high at the level of $11,100. The next target for bulls should be the level of $11,227 and $11,927. The nearest support is seen at the level of $10,000 and $9,985 (weekly pivot). The momentum is still strong and pointing to the upside, so more upwards pressure should be expected.