Eurozone

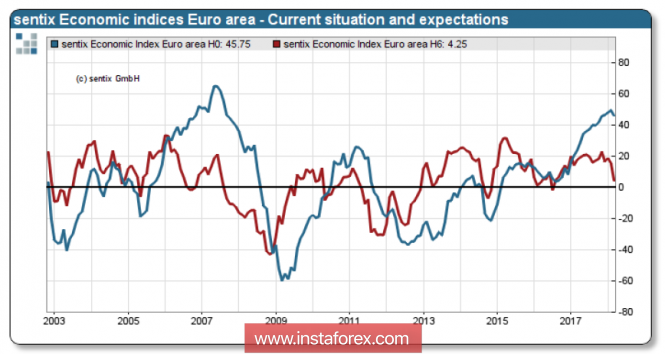

The confidence index of investors Sentix in the eurozone unexpectedly fell sharply to 24p in March against 31.9p a month earlier. In Germany, negative expectations have been formed for the first time since February 2016.

This obvious bearish signal could lead to sales of the euro. If not, there will be a similar decline in the USA, 5p in Japan and Switzerland.

The sharp deterioration in the business climate is associated with Trump's intentions to launch a policy of strict protectionism. "Who will pay for Trump's trade war?" is the question that is on the agenda.

Internal factors remain positive for the euro. On Thursday, the ECB meeting will take place, which will take into account both the results of the elections to the Italian parliament and the end of the epic with the formation of the ruling coalition in Germany.

The markets are not waiting for changes in the monetary policy, whereas in many respects old to hawkish measures will contribute to the growth of the euro and the further decline of the markets, which the regulator would like to avoid. Nevertheless, Mario Draghi was able to add volatility when he held a press conference.

According to the results of the week, the euro looks stronger and it is likely that the maximum of 1.2555 will be updated from February 16.

United Kingdom

The lack of significant macroeconomic data and some lull around the Brexit negotiation process allowed players to take a breath. The pound continues to trade in a wedge and a breakout could generate a strong impulse in either direction. The bottom of the pound is limited by strong support level of 1.3710 and resistance level of 1.3950.

Exit from the wedge can be held already this week. Friday will be sustained with news from the Bank of England, and will report on industrial production and trade balance for the month of January. A little later NIESR will present a forecast for GDP growth. The preliminary forecast is negative, so the chances of a fall look a little higher.

Also on Friday, the report on the US labor market, which can send dollar quotations in any direction. A slight advantage of the bears is likely to remain until Friday.

Oil

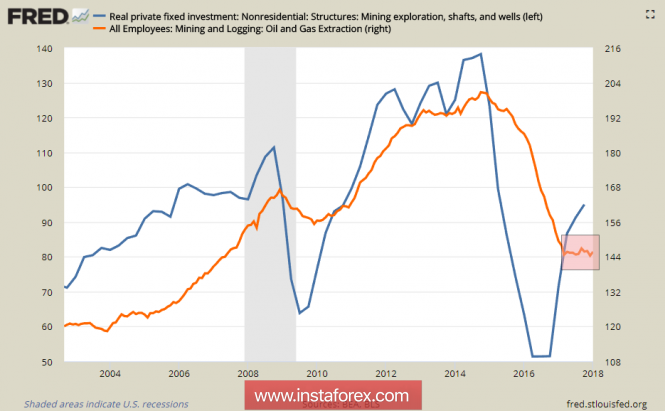

The annual energy conference was held in Houston, USA, where PEC representatives are supposed to enter into a dialogue with the leaders of American oil companies involved in the development of shale deposits. The very fact of such meetings has a positive character for the oil market and shows that dialogue is not only possible but also useful for the parties. One possible reason is that the withdrawal capabilities of the United States are not as high as they are sometimes served in the media. The U.S. will not be able to compensate for the decline in OPEC + production, while shale projects are still less profitable. On March 28, the final data for 4 square meters will be published, as well as, the level of investment in the extractive industry. Despite the growth in the 2 previous quarters, there is no certainty of maintaining the trend.

As for the labor market, the extractive industry does not create new jobs, without which, a significant increase in production is impossible.

Everything indicates that the OPEC + agreement continues to be the dominant factor determining the current quotes. The success of the agreement changes priorities in the oil market and Chad, Congo and Malaysia have applied for membership in the cartel.

Balance in the oil market is expected by the end of 2018, oil continues to hold above the comfortable level for participants with 64 dollars per barrel. There is likely to be an attempt to resume growth, for which it is necessary to go above $ 66 / bbl. for Brent.

The material has been provided by InstaForex Company - www.instaforex.com