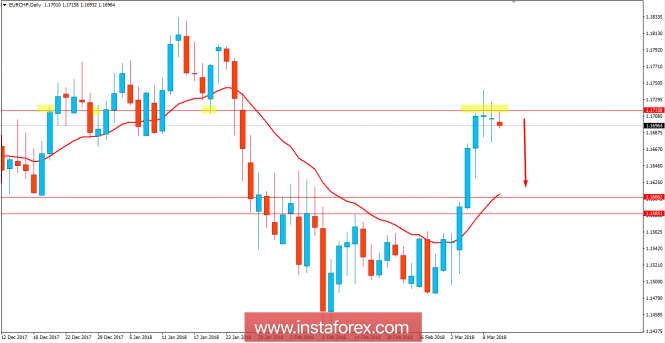

EUR/CHF has been impulsive with the bullish pressure after breaking above the 1.16 price area recently, but currently is observed to be struggling at the edge of 1.1715 with recent daily candles. This week, EUR/CHF is expected to be quite volatile having high impact economic reports to be published back to back on EUR and CHF. On Wednesday, ECB president Draghi is going to speak about the upcoming interest rate decision and future monetary policies whereas it is expected to be quite neutral for the immediate impact in the EUR gains. Today, Euro Group Meeting is going to be held where the event is expected to have minimum impact on the EUR gains as well. On the other hand, on Thursday CHF Libor Rate is going to be published which is expected to be unchanged at -0.75% and SNB Monetary Policy Assessment is also expected to be quite hawkish in nature having recent positive economic reports to be commented on. As of the current scenario, this week, CHF is expected to gain further momentum over EUR which is expected to lead to further bearish pressure in the pair.

From the technical view, the price has recently rejected off the 1.1715 price area with several daily candles which is expected to lead to further bearish pressure with the target towards the 1.16 support area in the coming days. The dynamic level of 20 EMA is currently residing below the current price area which is also expected to pull the price down for the confluence in the upcoming price action. As the price remains below the 1.1750 price area with a daily close, further bearish pressure is expected.