USD/CAD has been impulsive and non-volatile with the bullish gains after breaking and retesting off the 1.2620 price area. Ahead of the possible US rate hike this month, the gains of USD has been quite impulsive which may lead to further bullish pressure in the pair. Today USD ISM Manufacturing PMI report was published with an increase to 60.8 from the previous figure of 59.1 which was forecasted to decrease to 58.7. Construction Spending is projected to decrease to 0.0% from the previous value of 0.8% which was expected to be at 0.3%. The ISM Manufacturing Price has increased to 74.2 from the previous figure of 72.7 which was predicted to be at 70.5. Moreover, Fed Chair Powell is going to speak today about the short-term interest rates and future monetary policy, which is likely to be quite hawkish in nature and US President Donald Trump is going to speak today which would inject good amount of volatility in the market. On the other hand, ahead of the CAD GDP report to be published tomorrow which is predicted to decrease to 0.1% from the previous value of 0.4%, today CAD Current Account report was published with less deficit at -16.3B increasing from the previous negative value of -18.6B which was forecasted be at -17.8B. The Manufacturing PMI report was published with a slight decrease to 55.6 from the previous figure of 55.9. As of the current scenario, despite having positive economic reports, CAD failed to put pressure on USD gains leading to further bullish pressure in the pair. Currently, the price is expected to push higher for a certain period before any bearish intervention can be observed.

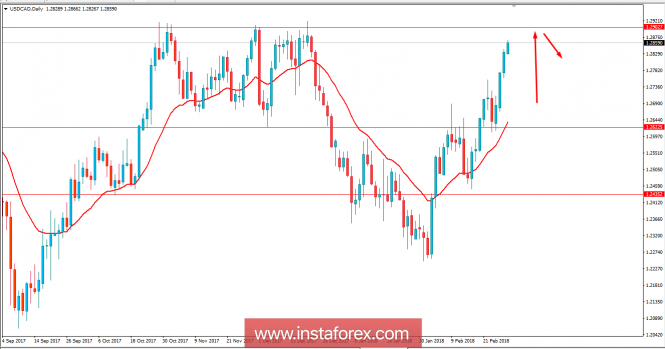

Now let us look at the technical view. The price has been quite impulsive with the gains, which is expected to show some bearish pressure off the resistance area of 1.2850-1.2900. As the price remains below the 1.2900 price area, there are good amount of probability for bearish pressure as the dynamic level of 20 EMA has been quite far from the current price which is likely to attract the price a bit lower before it pushes up higher in the coming days.