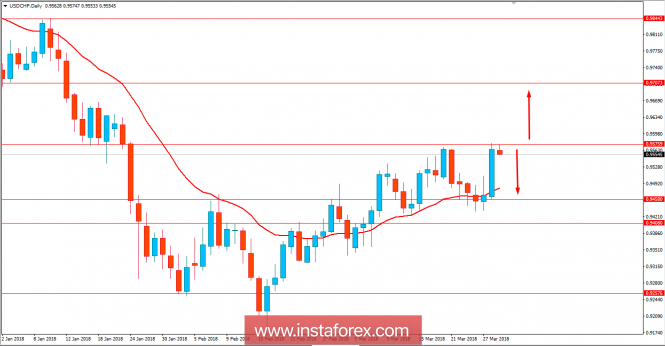

USD/CHF has been quite impulsive with the bullish gains recently which lead the price to jump straight towards 0.9450 to 0.9575 price area. Recent positive USD Final GDP increase to 2.9% from the previous value of 2.5% which was expected to be at 2.7%, had a good impact on the USD gains which lead the impulsive bullish pressure recently. Though the market is still inside a right resistance area of 0.9575 area whereas certain consolidation is expected. Today USD Core PCE Price Index report is going to be published which is expected to decrease to 0.2% from the previous value of 0.3%, Personal Spending is expected to be unchanged at 0.2%, Unemployment Claims is expected to increase to 230k from the previous figure of 229k and Personal Income is also expected to be unchanged at 0.4%. Moreover, Chicago PMI report is expected to have a slight increase to 62.1 from the previous figure of 61.9, Revised UoM Consumer Sentiment is expected to have slight decrease to 101.9 from the previous figure of 102.0 and Revised UoM Inflation is expectation is expected to be neutral which previously was at 2.9%. On the other hand, ahead of the Good Friday holiday to be observed in Switzerland tomorrow, today KOF Economic Barometer report is going to be published which is expected to decrease to 107.3 from the previous figure of 108.0. As of the current scenario, the pair is expected to consolidate as the USD and CHF economic reports are forecasted to be quite dovish in nature which may lead to further consolidation in the coming days. To sum up, USD is expected to have an upper hand over CHF which is expected to result in further bullish pressure on the pair in the future.

Now let us look at the technical view. The price is currently residing below 0.9575 price area which is an important event level from where a certain bearish pressure is expected. The recent bullish impulsive daily candle did help the price to gain some momentum but a daily close above 0.9575 will lead to further bullish pressure on the pair. As the price remains above 0.94 price area, the bullish bias is expected to continue further.