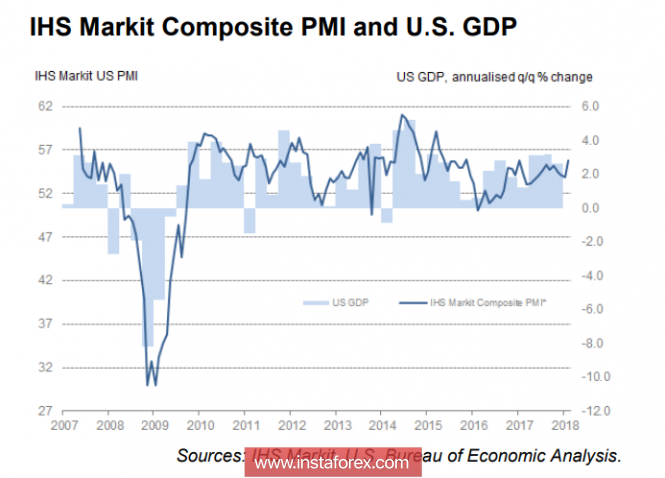

The US dollar weakly reacts to macroeconomic data, which in other conditions could support it. Markit's PMI in the services sector for February was better than expected, remaining at 55.9p, also better than the composite index. According to the version, the service sector also maintains high rates of expansion, the index is 59.5p against 59.9p a month earlier, better than expected.

The index of economic optimism IBD / TIPP, despite a slight decrease, continues to be in the area of multi-year highs, and, nevertheless, the dollar opened the week with a decline.

The fact is that the intention of Donald Trump to raise customs duties on certain groups of goods caused a negative impact. So serious that a number of high-ranking US officials are making serious efforts to change the course of events. The Republican leaders in charge of trade policy sent out a warning letter stating that the introduction of duties was an unfortunate idea, while Speaker of the House of Representatives Ryan spoke out against it.

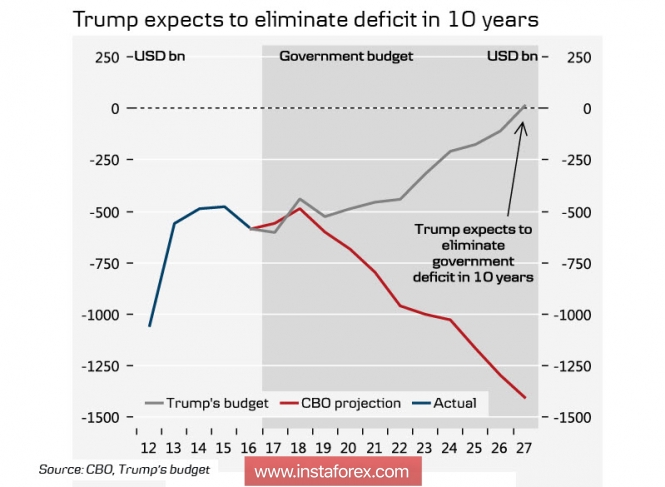

Why such attention to the words of Trump? The point here is not only in duties. Six months ago, the Congressional Budget Committee conducted an assessment of the economic consequences of the launch of the tax reform, in particular how it would affect the federal budget. The conclusion was that by 2027 the budget deficit will grow to more than 1.35 trillion dollars, with a tendency to further increase, while Trump promised to get rid of the deficit within the same period. Moreover, as early as 2018, the first positive progress was made by reducing the deficit to 400 billion dollars.

From what resources should such a plan be implemented? The United States does not have internal resources to reduce the budget deficit. The majority of negative trends are corporate incomes at the level of 3 years ago, that is, corporations will not be able to ensure a sharp increase in tax payments. Consumer confidence is at a high level, but there is almost no growth in spending either, at least the growth rates are clearly insufficient even to stop the growth of the deficit.

Thus, resources can only be external, that is, Trump implements the long-term harvesting of his economic team. The increase in duties is one of the steps that should increase budget revenues. To refuse from it, Trump can not, if he does not want to question the success of the reform as a whole.

If you do not raise duties, then where do you get money to close budget holes? Obviously, the only way is to expand the level of borrowing. The US financial position is deteriorating, the total basic balance of payments (BBoP), which is summarized from the current account, direct and portfolio investments, is projected to go down.

And as historical experience shows, the deterioration of BBoP always leads to a decrease in the dollar index. How else?

Thus, the dollar has rather weak prospects for resuming growth. Short-term support for the dollar can have a positive report on the labor market on Friday, as this result will be taken into account by the Fed at the meeting on March 21. Since the current unemployment rate is close to the natural limit, the market will pay attention to the number of new jobs in the second turn. Much more important is the growth rate of the average wage, at the moment it is one of the key criteria determining the probability of the fourth rate increase this year.

On Wednesday, you need to pay special attention to the introduction of the head of the Federal Reserve Bank of New York, William Dudley, perhaps he will comment on the likelihood of developing currency wars, as well as on the ADP report on employment in the private sector. A little later, a report on the growth rates of labor productivity in the 4th quarter and the Beige Book will be published, as well as the January dynamics of consumer lending volumes. In December, there was a decline in lending, if the data for January are also negative, the dollar may react with a fall due to the growing threat of low inflation.

The dollar will remain under pressure, attempts to grow should be used for sales across the entire spectrum of the market.

The material has been provided by InstaForex Company - www.instaforex.com