EUR/AUD has been in a non-volatile bullish trend since January 2018, which is expected to proceed much higher as of the current market structure. After the recent bearish pressure off the 1.62 price area, currently, the price is showing some impulsive bullish intervention. Today EUR Italian Monthly Unemployment Rate decreased to 10.9% from the previous value of 11.1% which was expected to be at 11.0%. Moreover, CPI Flash Estimate report was published as expected at 1.4% increase from the previous value of 1.1%, Core CPI Flash Estimate report was published unchanged at 1.0% which was expected to increase to 1.1% and Unemployment Rate was also published with a decrease as expected to 8.5% from the previous value of 8.6%. On the AUD side, today the economic reports were quite mixed in nature which did not help the currency to the extent as expected. Today AUD Retail Sales report was published with an increase to 0.6% from the previous value of 0.2% which was expected to be at 0.3%, Building Approvals report did not meet the expectation of -5.1% and resulted to -6.2% decrease from the previous 17.2%. As of the current scenario, a good amount of volatility is expected in the pair as AUD Trade Balance report and series of EUR economic reports are yet to be published this week. EUR is currently expected to have an upper hand over AUD but any impulsive bearish pressure may turn the table anytime this week.

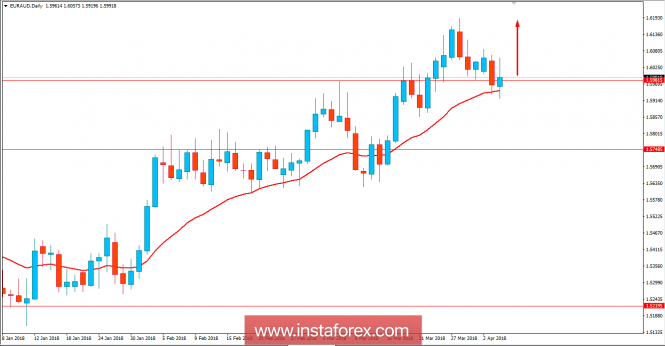

Now let us look at the technical view. The price is currently residing at the edge of 1.60 price area with confluence support of dynamic level of 20 EMA. The price is currently quite bullish in nature which will be confirmed with a daily close above 1.60. As the price remains above 1.59 area, the bullish bias is expected to continue further.