EUR/CAD has moved quite impulsively with the bullish gains today. The pair is expected to push higher with the bullish momentum for a while before proceeding lower in the short term. Today, after BOC Overnight Rate was declared unchanged as expected at 1.25%, BOC Monetary Policy was quite dovish with statements like considerable risk from escalating trade tensions which will impact the short-term growth of the economy but for the long term better results are expected. Moreover, BOC Press Conference is yet to be held, so a good amount of volatility is expected to be injected in the market today. On the other hand, US Crude Oil Inventories report is going reading on the USD side is expected to push the market to more indecision which will lead to a further corrective bias of the market sentiment. As for the current scenario, USD is expected to gain certain momentum over CAD for the coming days of the week whereas CAD is expected to gain momentum on the long-term basis as the bearish bias still exists in the market.

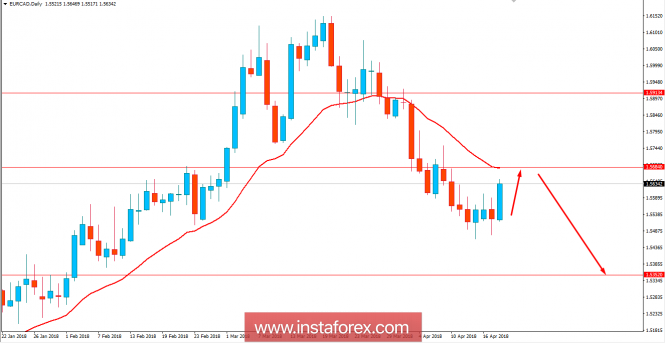

Now let us look at the technical view. The price is currently proceeding quite impulsively towards the resistance area of 1.57 from where with the confluence of dynamic level of 20 EMA as resistance, the price is expected to continue its bearish pressure with a target towards 1.5320 in the coming days. The consolidation after the strong bearish trend is currently correcting itself pretty well but more volatility is expected until the daily close today. As the price remains below 1.59, the bearish bias is expected to continue further.