EUR/JPY has recently breached above the 133.00 price area with a daily close which is expected to push the price much higher towards 134.50-135.00 resistance area. Ahead of the ECB Press Conference and the Minimum Bid Rate report to be published, certain impulsive gain over JPY during the Italian Holiday is quite remarkable and indicates the strength the euro possess right now in the market. Today there is no economic reports or events on the EUR side to impact the market momentum, but tomorrow the Minimum Bid Rate report is going to be published which is expected to be unchanged at 0.00%. At the same time, the ECB Press Conference is also expected to be neutral in nature. On the other hand, ahead of the BOJ Policy Report to be published on Friday which is expected to be unchanged at -0.10%, JPY has been being dominated by the EUR since the price broke above 132.00 area with a daily close. Today Japan's All Industry Activity report showed an increase to 0.4% from the previous negative value of -1.1% but it failed to meet the expectation of 0.6% which ultimately lead JPY to lose more grounds against EUR resulting to more gains on the bullish side in the pair. As of the current scenario, EUR is expected to sustain its bullish momentum in the coming days whereas JPY may struggle to counter this impulsive pressure. Ahead of the upcoming high impact economic reports and events on the both currencies in the pair this week, the price is expected to be highly volatile before this weekend. To sum up, EUR is expected to have an upper hand over JPY in the nearest future.

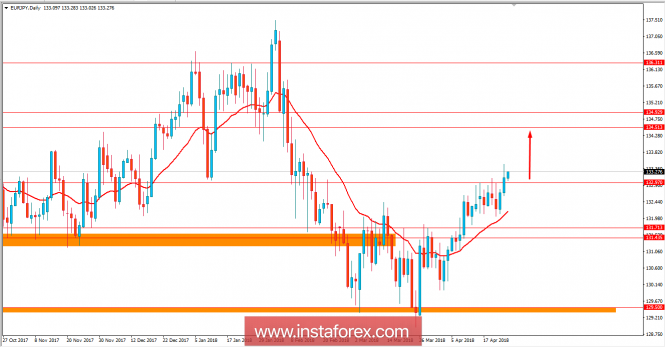

Now let us look at the technical view. The price is currently residing above 133.00 area with an impulsive bullish momentum which is expected to drive the price much higher towards 134.50-135.00 area in the coming days. The price has been quite volatile and corrective before it broke above 133.00 area with a daily close, and as the bullish pressure is sustained in the market, further upward momentum is expected along with certain retracement in the process. As the price remains above 132.00 area, the bullish bias is expected to continue.