NZD/USD has been impulsive and non-volatile with bullish gains which are expected to proceed higher in the coming days. USD has been struggling with the gains against NZD due to recent downbeat high impact economic reports which made the NZD sustain its gains despite mixed economic reports from New Zealand. Today, Business NZ Manufacturing Index report was published with a decrease to 52.2 from the previous figure of 53.3, which did not quite affect the bullish bias on the market but slowed down the bullish rally for a while. On the other hand, USD has been struggling to maintain its gains amid a series of weak economic reports. Today, US Prelim UoM Consumer Sentiment report is going to be published which is expected to decrease to 100.6 from the previous figure of 101.4, JOLTS Job Opening is expected to decrease to 6.11M from the previous figure of 6.31M, and Prelim UoM Inflation Expectation is expected to be neutral whereas previously it was at 2.8%. As for the current scenario, expectations for the upcoming US economic reports are dovish in nature whereas better-than-expected readings will lead to more bullish gains on the NZD side for the coming days. To sum up, after certain correction along the way, NZD is expected to dominate USD further in the coming days.

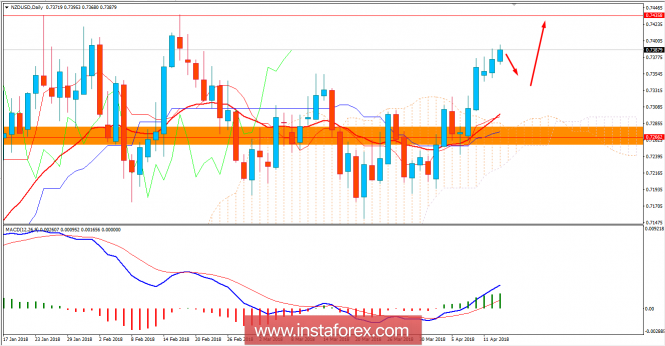

Now let us look at the technical view. The price is currently quite bullish residing above 0.7350 area from where certain bearish pressure is expected which will lead to certain retracement in the pair before it launches itself higher towards 0.7450 price area in the coming days. As the price remains above 0.7250 with a daily close, further bullish pressure is expected.