USD/CAD has been consolidating below 1.2620 price area since it broke below the level from where certain retracement is currently expected before price proceeds lower in the nearest days. USD has failed to retain its bullish momentum earlier this month due to worse-than-expected economic reports which shifted the market sentiment towards CAD in an impulsive manner. Today is an important day for CAD as Canada is due to release a series of high impact economic reports. Today, Canada's Overnight Rate is going to be published which is expected to remain unchanged at 1.25% along with BOC Rate Statement and BOC Monetary Policy report. Since the January rate hike from 1.00% to 1.25%, the unchanged interest rate in the country seems to be depend on the current inflation rate. On the other hand, amid the hawkish stance of the US FED for this year, USD is being dominated by CAD recently. Recently, US Building Permits report showed an increase to 1.35M from the previous figure of 1.32M and Housing Starts was also published with an increase to 1.32M from the previous figure of 1.30M. The positive economic reports helped the currency to sustain certain bullish pressure in the pair and resist further impulsive bearish pressure. Today, FOMC Member Dudley and Quarles are going to speak. Their remarks are expected to have minor impact on the market sentiment. This week, USD is expected to be quite slow in comparison to all other major currencies as there is not many economic reports or events to shift the market sentiment in an impulsive manner. As for the current scenario, CAD is expected to continue its impulsive bearish pressure having certain corrections along the way in the coming days.

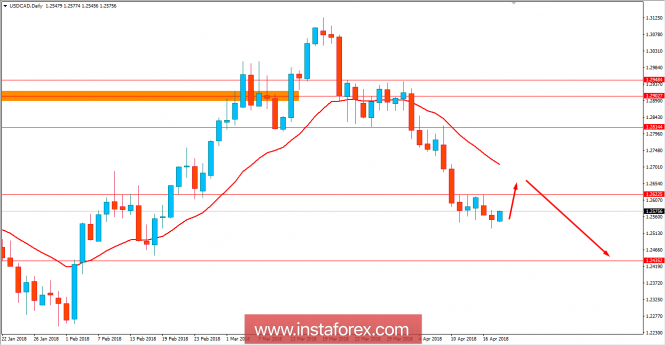

Now let us look at the technical view. The price is currently showing some bullish impulsive pressure below 1.2620 price area from where it is expected to retrace higher towards 1.2620-1.2650 area before the price proceeds lower towards 1.2450 in the coming days. As the price remains below 1.28 price area, the bearish bias is expected to continue.