USD/CHF has been quite non-volatile and impulsive with the bullish gains recently. As a result, the price is holding above 0.97 area that is expected to proceed much higher in the coming days. Though USD is struggling to sustain its gains against other major currencies in the market, it has been dominating CHF since the price broke above 0.9250 area. This week, Switzerland's PPI report was published with a decrease to -0.2% from the previous value of 0.3% which was expected to increase to 0.4%. The downbeat economic report helped USD to be more impulsive with the bullish gains and dominate CHF further in a non-volatile structure. On the other hand, USD has been quite positive with the economic reports recently like Building Permits report increasing to 1.35M from the previous figure of 1.32M and Philly Fed Manufacturing Index report showed an increase to 23.2 from the previous figure of 22.3. Today, FOMC Member Williams is going to speak about the economic development, interest rates and monetary policy which is expected to have a neutral impact on the pair for the nearest days. As for the current scenario, USD is expected to strengthen its gains further against CHF in the coming days until CHF comes up with better economic reports to counter the impulsive bullish pressure in the pair.

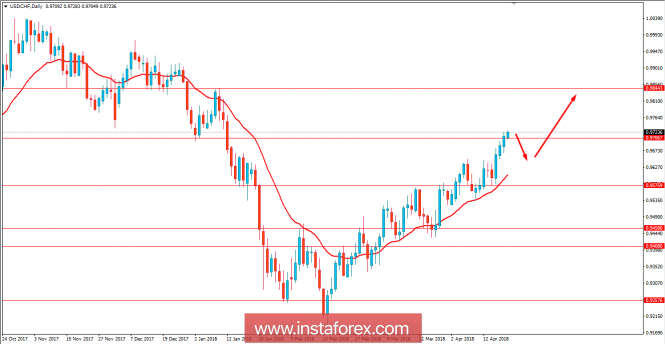

Now let us look at the technical view. The price has been non-volatile with the bullish gains residing and respecting dynamic level of 20 EMA since it broke above 0.9450 area. The bullish momentum is currently quite strong in nature and certain retracement along the way will not impact the bullish bias in the market. As the price remains above 0.9450 with a daily close, further bullish pressure is expected.