USD/JPY is currently residing inside the resistance area of 108.50-109.20 from where it is expected to push lower in the coming days. USD has been the dominant currency in the pair since last week's positive economic reports were published. Recently USD Existing Home Sales report was published with an increase to 5.60M from the previous figure of 5.54M which was expected to have a slight increase to 5.55M. The positive economic report did help the currency to sustain the bullish momentum in the pair whereas some volatility may be injected today with the upcoming economic reports. Today, USD CB Consumer Confidence report is going to be published which is expected to decrease to 126.00 from the previous figure of 127.7, New Home Sales is expected to increase to 625k from the previous figure of 618k and Richmond Manufacturing Index is expected to increase as well to 16 from the previous figure of 15. On the other hand, today JPY SPPI report was published with a decrease to 0.5% as expected from the previous value of 0.7% and BOJ Core CPI was also published with a decrease to 0.7% as expected from the previous value of 0.8%. Ahead of the Unemployment Rate, BOJ Monetary Policy Statement along with BOJ Policy Rate and Tokyo Core CPI report to be published on Friday this week, certain worse economic reports are quite unexpected for a better growth of the currency for the coming days. As of the current scenario, USD is expected to continue its dominating behavior over JPY as certain high impact USD economic reports are going to be published this week whereas the positive economic reports are currently fueling the bullish gains in the pair.

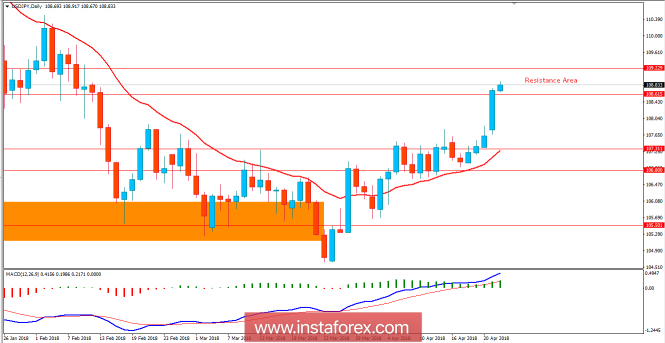

Now let us look at the technical view. The price is currently residing inside the resistance area of 108.50 to 109.20 area where the price action has turned quite slow and steady after an impulsive bullish pressure yesterday. The dynamic level of 20 EMA is way lower towards 107.50 area where the price is expected to retrace back before proceeding much higher in the coming days. Currently, the price is expected to proceed lower off the resistance area with an objective to retrace for a certain period as of Bearish Continuation Divergence is in the process of forming currently. As the price remains above 106.80 area, the bullish bias is expected to continue to push the price higher after every retrace.