In the first quarter, the British pound gained 4% against the US dollar as the political risks were reduced and showed a greater chance to continue the normalization cycle of the Bank of England's monetary policy in May, with a probability higher than 80%. Inflation slowed down from 3% to 2.7% and wages grew to 2.8%, which can be relied on increasing the purchasing power of the population and the acceleration of GDP. As a result, the factor of underestimation can play on the side of the pound.

While the OECD claims that the economy of Foggy Albion will show the slowest growth rates among developed countries, this pleasant surprise was able to help the "bulls" in the GBP / USD to restore an upward trend. For instance, it is not necessary to go far since Bloomberg experts gave the modest estimates of the eurozone's GDP for last year at + 1.7% at the end of 2016. In fact, the indicator was satisfied with the 2.5% rally and became one of the major drivers of strengthening the euro by 14%, which further served as a hint to the future dynamics of the Foggy Albion economy and an evidence from business activity. The statistics on purchasing managers indices adds pressure to the economic calendar and pushes the pound to the most interesting currency for the first week of April.

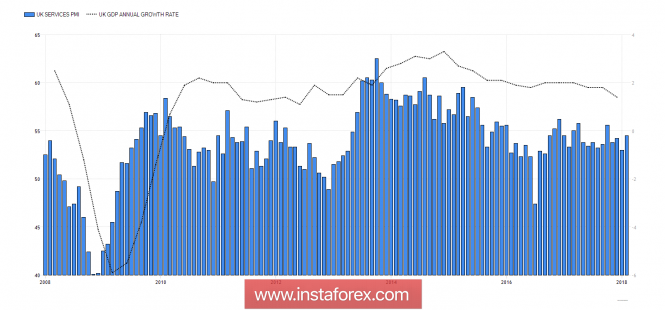

Dynamics of PMI in services and GDP in Britain

The PMI forecasts in production were moderately negative (54.7 versus 55.2 in February) and construction sectors (50.8 against 51.8), as well as in services (54 versus 54.5) which may become some kind of predictions to what will happen to the pound for the rest of the year. Strong factual data inspire "bulls" for GBP / USD to take advantage.

The macroeconomic statistics came in positive coupled with the decision on the transition period for Britain until 2019, which should be interpreted as a reduction in political risks and untie the hands of the Bank of England. The Committee on Monetary Policy has plenty of "hawks" who were waiting for signals from Brussels. The futures market expects an increase in repo rates in May and November, while the normalization cycle may continue in February 2019. Adjustments to this trajectory can be made by politics and the economy. In particular, "bears" for sterling say that it is improper to speak about the certainty regarding the Brexit and refer to volatility growth from 7.8% in October-December to 8.3% in January-March. On the other hand, ING claims that the pound's intense response to the transitional report indicates its underestimation.

When predicting the future dynamics of the GBP / USD currency pair, one should not forget about certain factors such as trade wars. The exchange of import duties between the US and China worsens the global appetite for risk, which negatively affects the desire of investors to invest in British financial markets and also a deterrent for sterling.

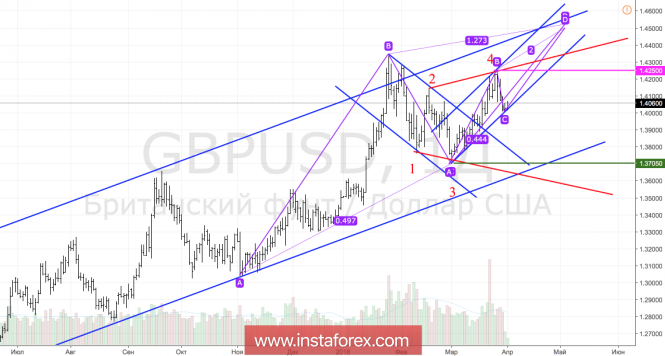

Technically, the essential condition for the recovery of the "bullish" trend for GBP / USD is a breakthrough resistance at 1.425. In this case, the secondary pattern AB = CD with a target of 200% will be activated. While the pair's quotes are above 1.3705 and the situation is controlled by the buyers.GBP / USD daily chart

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com