The long weekend contributed to the consolidation of major currency pairs in fairly narrow trading ranges. However, it is unlikely that the period of uncertainty will drag on for a long time.

One of the most important markers, indicating that tensions will continue to grow, is the situation in the US stock markets. On Monday, the S&P 500 index lost more than 2.5% and was on the verge of a minimum test last February 9. A breakthrough support threatened a full-fledged collapse which was good as there are plenty of reasons for this. However, the latest news from the White House allowed Amazon shares to recover. Against this, some organizational measures were expected for the entire stock market as a whole.

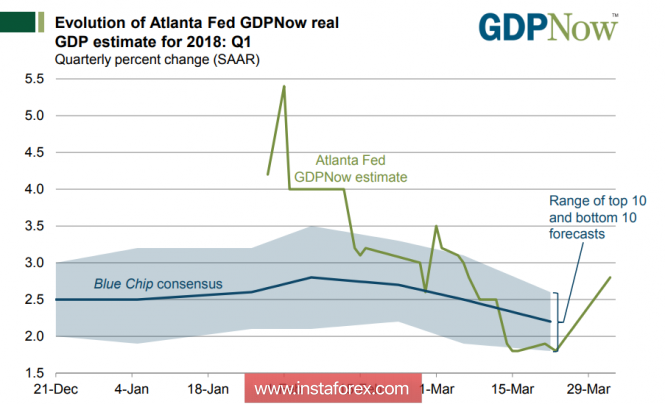

Nevertheless, there is no reason for complacency. The index of economic optimism IBD / TIPP which reflects the mood of consumers in relation to the prospects for the economy was published on Monday. It unexpectedly declined in April to 52.6p against 55.6p a month earlier, having lost all the acquisitions of recent months. Good data on personal expenses and the ISM index in the manufacturing sector allowed the forecast for GDP in 1 sq. Km.to rise up to 2.8%. However, this result will still be revised and, most likely, will go downward.

Despite the seemingly good result of the economic growth in the traditionally weak first quarter, let's not forget that Trump's tax program is not working yet. The government increased the level of the national debt by 661 billion for three months, raising the total bar to more than 21 trillion dollars. In other words, the national debt grows faster than the economy, which means that the problems are only growing.

Trump's desperate attempts to be like Reagan still lead to the opposite result because the world is not the same and the US is not the same. The introduction of customs restrictions on steel and aluminum caused an angry reaction from China and an immediate response, which came into effect already on April 2. Counter measures relate primarily to the supply of agricultural products to China, which will directly damage the most dedicated Trump electorate.

The US expressed dissatisfaction with China's response measures and announced that they are preparing a new package of restrictions, which is aimed primarily at high-tech industries. If this intention is implemented, then it will be extremely difficult to keep from a full-scale currency war, since China has officially announced that it will start dedollarization of foreign trade in this case.

This will be reflected, among other things, in the transfer of the main suppliers of raw materials to China, primarily oil from the Middle East, to be paid in yuan. China can do this because it is the largest buyer of oil on the planet and the monarchies of the Persian Gulf may simply not have a choice. These steps will cause irreparable damage to the dollar as the main world currency and it is in the interests of the US administration to not allow this development.

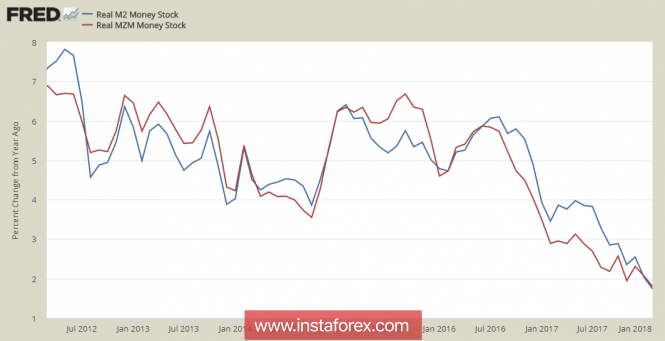

A probable trade war is only one of the markers of the general deterioration of the business climate. The beginning of the normalization of the monetary policy of the Fed led to the fact that the global monetary offer is starting to slow down and the pace of this slowdown is much higher than predicted.

The unpleasant conclusion from the slowdown in the growth rate of the money supply is that lending rates are declining at a high rate. If the Fed continues to reduce its balance at the planned rate of $ 50 billion a month by the fall of this year while raising rates, it is likely that the recession will begin in the US this year. Given that similar processes are observed both in the euro area and in Japan, then it is a likely onset of a global recession.

Thus, the second quarter opened against a backdrop of alarming prospects. The end of the week will pass in anticipation of the report on employment in the US. A result worse than forecasts may trigger a new wave of sales in the stock markets, which will lead to increased demand for protective assets. The latest CFTC report showed that speculators sharply increase their long positions in gold and, to a lesser extent, the Japanese yen, preparing for strong shocks.

The dollar will try to strengthen by the end of the week but the main favorites will be gold and yen, as the growth of panic moods becomes more and more probable every day.

The material has been provided by InstaForex Company - www.instaforex.com