Quotations for futures for Brent once again approached the psychologically important mark of $ 80 per barrel, after Washington intimidated Iran with unprecedented economic sanctions in the history. The states are going to get full access to Tehran's nuclear program, and if this does not happen, strangle the country with various kinds of restrictions. For example, to impose a ban on the purchase of public debt or on other types of investments, the need for which for the Iranian oil industry is estimated by experts of the Financial Times at $ 100 billion. Sanctions risk decreasing the production of the second-largest producer in OPEC (2.4 million b / s) by 400 -1000 thousand b / s.

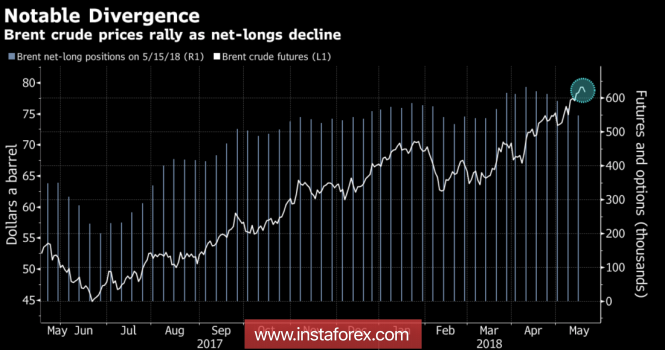

If, after the US withdrew from the nuclear agreement with Tehran in 2015, some speculators considered this factor to be backed up and rushed out of long positions, but now the market looks at the volume of actual supplies cuts that have already led to a fall in global black gold reserves to the lowest levels for the last 3.5 years. At the end of the five-day period, by May 15, the net-hedge funds of the North Sea variety decreased by 3.7%, to 548,555 contracts. The indicator falls for the fifth consecutive week.

Dynamics of speculative positions and quotations Brent

In addition to Iran, Venezuela is experiencing problems, where Nicholas Maduro was able to hold the power in his hands. The West acknowledged the election results illegitimate, and the States imposed a ban on the purchase of the country's national debt. The money raised in this way was used to modernize the oil industry, and if they do not exist, then production from the current level of 1.42 million b / s is likely to decrease substantially.

At the expense of Iran and Venezuela, other OPEC countries may, on the contrary, expand production, but the key question remains whether they are prepared to extend the Vienna agreement, which led to the market's entry into balance. Any kind of information on this subject on the eve of the June 22 cartel summit may be worth the weight of gold. The readiness of manufacturers for further cooperation will increase the risks of continuing the rally Brent and WTI. Many investors say that at a price of $ 100 per barrel they are hardly likely to surprise. As a confirmation of their hypothesis is the forward dynamics of futures contracts for the North Sea variety over its value in the spot market. Over the past month, the forward price has increased by 11%, the prices of the cash market - only by 6.8%. But after all, during the last at least three years, the indicators moved almost synchronously.

Trade conflicts between the US and China threatened global economic growth and forced the Ministry of Energy Information to lower the forecast for the increase in world oil demand in 2018 from 1.5 million to 1.4 million b / s. Nevertheless, Washington's decision to cancel $ 150 billion of import duties has returned optimism to the market.

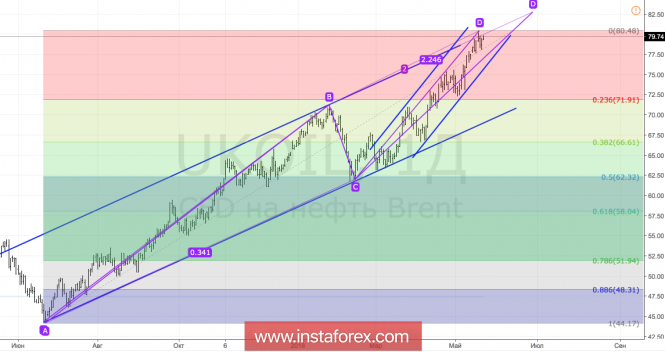

Technically, Brent quotes reached a target of 200% on the AB = CD pattern, which increases the risks of a pullback. Nevertheless, the update of the May maximum will open the way for the "bulls" to the north towards the target benchmark by 224%.

Brent, the daily chart