If the data on the number of housing permits of new homes in the US put pressure on the US dollar in the afternoon of Wednesday, May 16, then a good report on industrial production began to gradually return the US dollar to the buyer market.

It is important to note that the number of housing permits for new homes in the US for the month of April 2018 fell by 3.7% compared to the previous month and amounted to 1.287 million homes per year. The number of construction permits decreased by 1.8% compared to the previous month and amounted to 1.352 million homes per year. Economists had expected a fall in the number of tabs by 1.4% and the number of permits was only at 0.3%.

According to the report of the Federal Reserve System of the USA, industrial production in April of this year has grown. The growth was due to good demand from consumers, as well as small and medium-sized businesses.

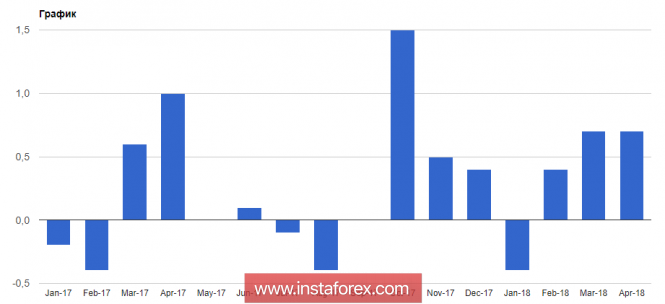

Thus, industrial production grew by 0.7% compared to the previous month and compared to the same period by 3.5%. The increase in capacity utilization to 78% for April of this year also indicates an increase in activity in the manufacturing sector. Economists had expected that production would grow by 0.6%, and the capacity utilization would be at 78.4%.

The negotiations between the US and China, which have not yet begun, are already at risk of failure. This is all because of the media that attacked the President of the United States Donald Trump indicating the desire of the presidential administration to soften American sanctions against the Chinese telecommunications giant ZTE Corp.

All this led to the fact that in his Twitter account, Trump said that there would be no concessions to the Chinese side. It is important to note that a delegation from China arrived in the United States, headed by Vice-Premier of the State Council of the People's Republic of China Liu He. The main purpose of the negotiations is an agreement that will allow to weaken sanctions from the US against ZTE in exchange for softening the position of China regarding duties on American agricultural products.

Quotes of oil rose after data on commercial oil reserves in the US.

According to the report of the US Department of Energy, for the week of May 5 to 11, oil reserves fell by 1.4 million barrels to 432.4 million barrels, while economists assumed a fall in oil reserves of 400,000 barrels. The reserves of gasoline fell by 3.8 million barrels to 232 million barrels, and stocks of distillates by 92,000 barrels to 114.9 million barrels. The load of oil refining capacities increased to 91.1%, while analysts had expected the growth of the index by 0.4 percentage points.

The material has been provided by InstaForex Company - www.instaforex.com